In the wake of its fiscal third-quarter earnings report, Dell Technologies has witnessed a sharp decline in its stock price, despite strong performances in certain key areas, particularly in the AI sector. The company’s revenue figures fell short of Wall Street’s expectations, with Dell’s outlook for the fourth quarter also coming in lower than analysts had hoped. This drop, coupled with the company’s admission that growth from AI systems will be unpredictable, sent its shares tumbling by 10% in after-hours trading.

Here's ads banner inside a post

Beating Expectations on Earnings Per Share

Dell Technologies reported earnings per share (EPS) of $2.15, adjusted, which exceeded the analyst expectations of $2.06. This marks a strong performance in profitability for the company, especially given the market turbulence surrounding its forecast. The company also posted net income of $1.12 billion, an increase of 12% compared to the $1 billion from the same quarter last year. Dell’s earnings growth is noteworthy, considering the tech giant’s shift towards artificial intelligence (AI), cloud computing, and other high-performance computing technologies.

Here's ads banner inside a post

However, despite this positive earnings report, Dell’s overall revenue for the quarter reached $24.4 billion, which was lower than the $24.67 billion analysts had forecasted. The company attributed this shortfall to a combination of shifting customer demand patterns and a delay in certain orders for AI systems, particularly those relying on Nvidia’s latest Blackwell AI chips. While Dell’s revenues did see an increase of around 10% year-on-year from $22.25 billion, it still fell short of analysts’ projections.

A Glimpse into the Future: AI’s Growing Role

The most significant aspect of Dell’s recent growth is its expanding involvement in the AI space. The company is one of the most important players in the market, providing AI tools and systems to developers and enterprises looking to deploy artificial intelligence. Dell’s shares had already surged by 86% in 2024, fueled by the increasing demand for AI infrastructure and the company’s prominent role in delivering AI servers.

Here's ads banner inside a post

As AI technologies continue to proliferate across industries, Dell has positioned itself as a key vendor for AI servers and related hardware. These systems, which often rely on Nvidia’s powerful AI chips, are in high demand from cloud service providers, government institutions, and large enterprises. For example, Dell’s computer clusters, designed to support AI applications, are considered among the most robust and efficient in the market.

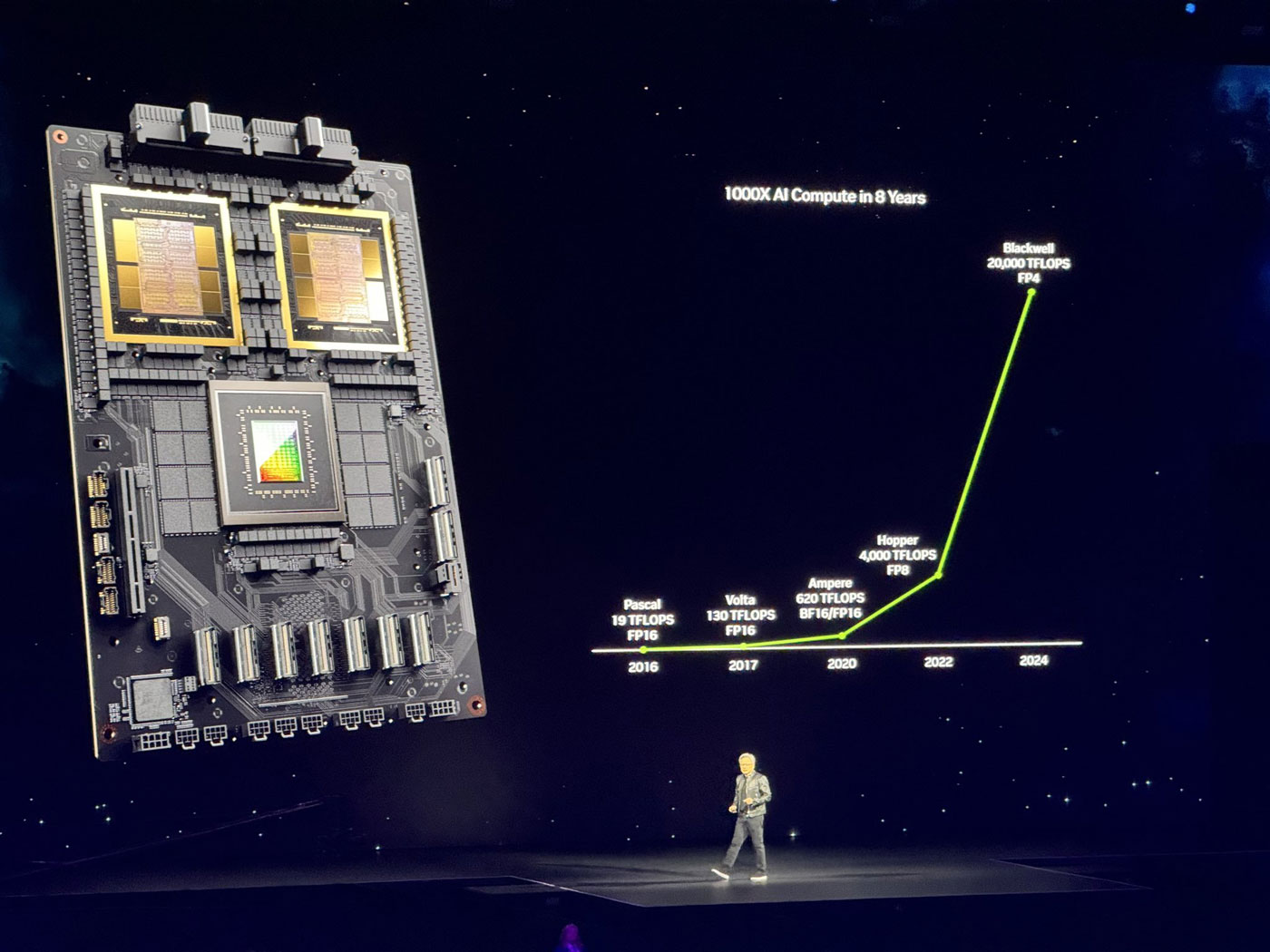

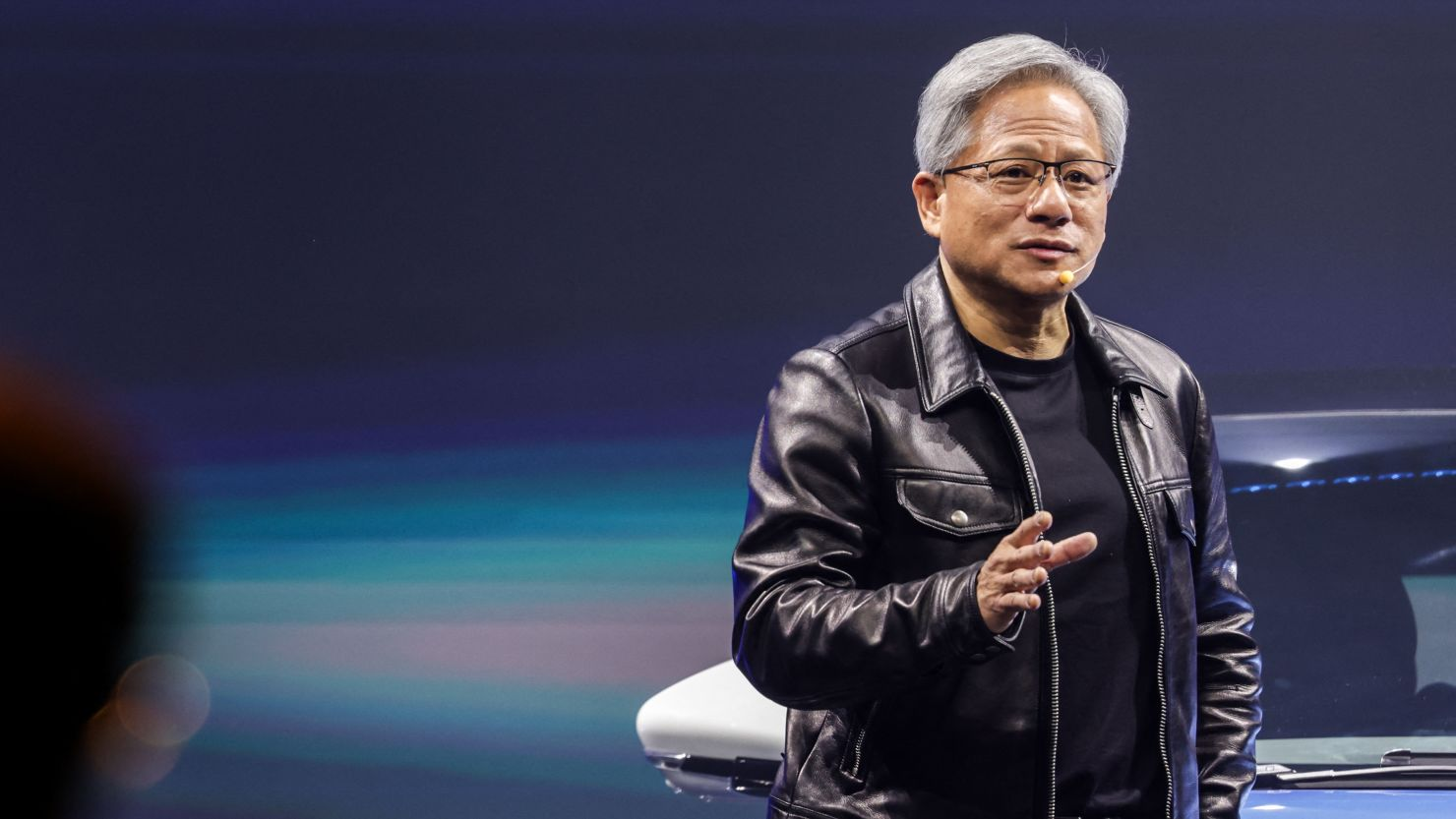

The demand for AI accelerators, particularly Nvidia’s graphics processing units (GPUs), has been soaring. Dell has been a primary distributor of these high-performance AI systems, providing customers with the hardware necessary to develop and deploy AI models. In fact, in a March address, Nvidia CEO Jensen Huang praised Dell as the go-to company for placing orders for its latest Blackwell AI chips, underscoring Dell’s strategic position in the AI hardware market.

Shifting Demand and Unpredictable Growth

Despite the optimistic view surrounding AI, Dell executives expressed caution about the immediate future. Chief Operating Officer Jeff Clark noted that growth from AI would not be linear and could vary significantly from quarter to quarter. One of the primary reasons for this unpredictability is the evolving nature of the silicon roadmap, as customers adapt to new chip generations like Nvidia’s Blackwell chips. While these chips are still in production, Dell’s customers have already begun shifting their orders toward these next-generation products, leading to potential delays in the short term.

In fact, much of the revenue growth attributed to AI is already reflected in Dell’s impressive $4.5 billion pipeline of future orders. The company’s executives emphasized that the enterprise sector is still in the early stages of learning how to deploy AI effectively. According to Clark, “We’re only in the very early innings of enterprises learning how to deploy AI.” This suggests that while AI sales may not generate immediate gains, there is long-term potential for growth as companies continue to integrate AI systems into their operations.

Infrastructure Solutions Group (ISG): AI’s Key Growth Driver

Dell’s growth in the AI space is primarily reflected in its Infrastructure Solutions Group (ISG), which includes AI servers, storage solutions, networking components, and traditional servers. In the fiscal third quarter, the ISG unit’s revenue rose by 34%, driven by the increasing demand for AI systems. Overall, the ISG business generated $11.4 billion in revenue, with servers and networking components, including AI servers, seeing particularly strong growth.

Dell’s servers and networking segment experienced a 58% year-on-year revenue increase, reaching $7.4 billion. During the quarter, Dell shipped $2.9 billion worth of AI servers, reflecting robust demand for AI-related products. The company also reported that customers had already booked $3.6 billion in future AI server orders. This represents a significant pipeline of business, which will contribute to Dell’s long-term revenue growth.

Interestingly, Dell’s AI server sales also had a positive impact on its traditional server business. The company revealed that orders for non-AI servers saw double-digit growth as customers began upgrading their infrastructure to accommodate the rising power needs of AI systems. These less power-hungry servers, which are based on processors from Intel and AMD, are used to free up capacity within data centers, allowing companies to invest in more advanced AI infrastructure.

Client Solutions Group: Mixed Results in Consumer and Commercial Sales

While Dell’s performance in the AI space was strong, its Client Solutions Group (CSG), which includes personal computers (PCs) and laptops, saw more mixed results. The group’s revenue for the quarter amounted to $12.1 billion, which represents a 1% year-on-year decline. Sales from commercial clients, such as businesses purchasing PCs for their workforces, rose by 3% to $10.1 billion. However, Dell’s consumer PC sales declined sharply by 18%, falling to $2 billion.

This drop in consumer sales is not entirely unexpected, as the PC market has been facing challenges due to the ongoing shift to mobile and cloud-based computing. Furthermore, the macroeconomic environment, including rising interest rates and inflation concerns, has dampened consumer spending in the tech sector. Despite these challenges, Dell’s continued success with commercial clients highlights the ongoing demand for reliable and high-performance PCs and laptops in the enterprise sector.

A Challenging Outlook for the Fourth Quarter

Looking ahead to the fourth quarter, Dell Technologies is projecting revenues between $24 billion and $25 billion, which is below Wall Street’s expectations of $25.57 billion. The company also forecast adjusted earnings per share (EPS) of $2.50, which falls short of analysts’ expectations of $2.65 per share. Despite the ongoing growth in AI sales, Dell’s executives acknowledged that demand would be affected by the shift to Nvidia’s Blackwell chips and the evolving nature of enterprise AI deployments.

Dell’s overall performance in the fourth quarter will likely depend on how quickly customers begin to fully embrace AI and whether the next-generation chips from Nvidia can meet their needs. The company’s strong pipeline of AI-related orders, however, indicates that the potential for growth in this space is significant, even if growth is somewhat unpredictable in the near term.

Navigating the AI Boom: Dell’s Path Ahead

In conclusion, while Dell Technologies has faced a setback in the short term due to its lower-than-expected fourth-quarter forecast, the company’s long-term prospects remain strong, particularly in the growing AI market. As businesses and enterprises continue to invest in AI infrastructure, Dell is well-positioned to capture a significant share of this lucrative market. However, the company will need to navigate the uncertainties of chip production cycles and evolving customer needs to maintain its momentum. The next few quarters will be crucial in determining whether Dell can sustain its growth trajectory and capitalize on the AI boom.