On Friday, November 22, 2024, Bitcoin reached another record high, edging closer to the $100,000 mark. This remarkable rally has been fueled by expectations of a more crypto-friendly regulatory environment under the leadership of Donald Trump.

Here's ads banner inside a post

Bitcoin’s Meteoric Rise

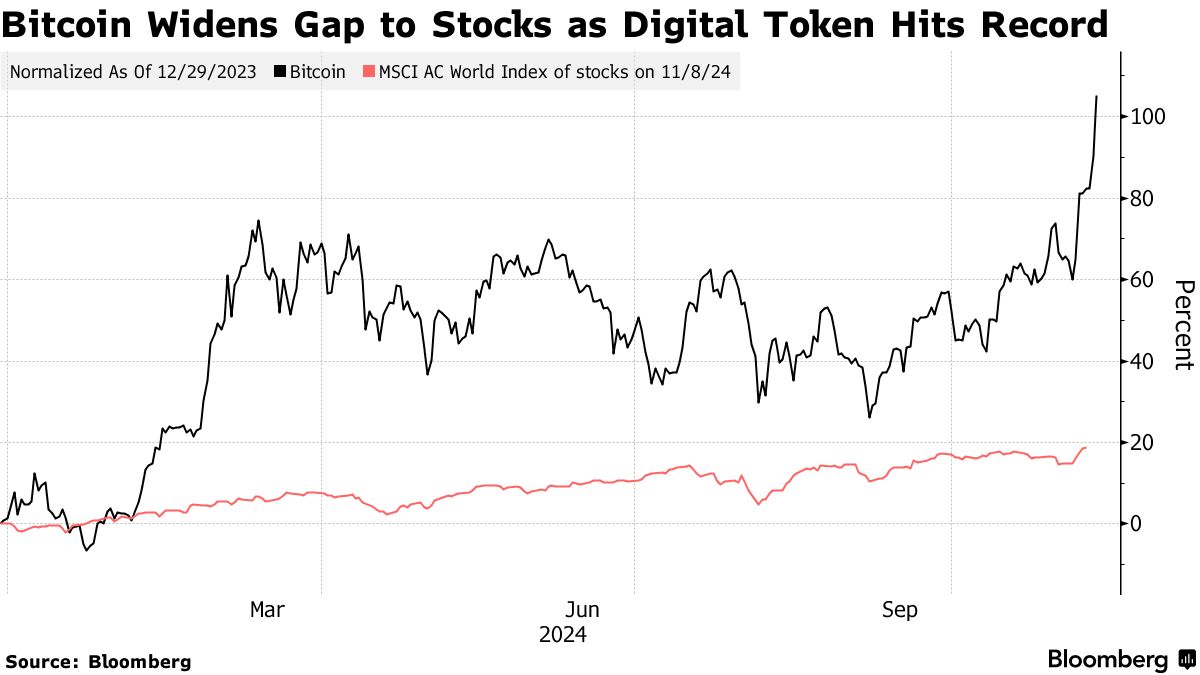

Bitcoin has more than doubled in value this year, with a 45% increase in just two weeks following Trump’s sweeping victory in the U.S. presidential election. The event also ushered in a wave of pro-crypto lawmakers into Congress, further boosting optimism in the cryptocurrency market.

By the end of the day, Bitcoin rose over 1%, hitting $99,380, and is on track for its best monthly performance since February 2024.

Key Drivers Behind the Rally

Regulatory Optimism Under Trump

Donald Trump’s victory has not only reshaped U.S. politics but also brought new hope to the cryptocurrency community. Trump and his administration are perceived as more open to digital assets, attracting substantial capital inflows into Bitcoin and other cryptocurrencies.

Here's ads banner inside a post

A significant number of pro-crypto legislators have also entered Congress, paving the way for potential regulatory reforms. These changes could strengthen Bitcoin’s legitimacy and expand its real-world applications, bolstering investor confidence.

“Trump Trades” and Bitcoin’s Success

Bitcoin has emerged as one of the standout winners of the so-called “Trump Trades” — assets that are predicted to benefit from Trump’s policies. Investors are betting that the new administration will create a more favorable business environment for fintech and digital assets.

Sustained Growth in 2024

Bitcoin’s rally is not a standalone event. In 2024, several positive developments for cryptocurrencies have occurred, including the rise of Bitcoin Exchange-Traded Funds (ETFs) and greater adoption by major financial institutions. Leading investment banks like JPMorgan and Goldman Sachs have expanded their cryptocurrency services, making Bitcoin more accessible to traditional investors.

Here's ads banner inside a post

Potential Risks Ahead

While Bitcoin’s growth is impressive, the market still faces several risks:

- Price volatility: Bitcoin is notorious for its dramatic price swings, which can deter new investors or trigger widespread sell-offs.

- Regulatory uncertainty: Despite optimism about Trump’s policies, cryptocurrencies remain under strict regulation in many other countries.

- Short-term speculation: Excessive speculative trading could lead to market bubbles if not properly managed.

The Future of Bitcoin: Reaching $100,000

The $100,000 mark is not just a psychological milestone but also a symbol of Bitcoin’s growing acceptance in global financial systems. If the current momentum continues, Bitcoin could evolve beyond being an investment asset to becoming a widely accepted digital currency.

Practical Applications and Adoption

The growth of blockchain applications and the integration of Bitcoin into payment systems have paved the way for broader recognition. Companies like Tesla, PayPal, and Visa have already accepted Bitcoin for transactions, further accelerating its mainstream adoption.

Institutional Investment

An increasing number of institutional investors view Bitcoin as “digital gold” — a hedge against inflation. Capital inflows from investment funds and institutional players have provided Bitcoin with a stable growth trajectory.

Global Impact

Bitcoin is not just a financial phenomenon; it is a symbol of technological innovation. Its rise has reshaped global perceptions of currency and digital assets. Countries like El Salvador have embraced Bitcoin as legal tender, while other governments are exploring Central Bank Digital Currencies (CBDCs) to compete with Bitcoin’s dominance.

Conclusion

Bitcoin is inching closer to the historic $100,000 mark, signifying the maturity of an asset once deemed highly volatile. Backed by factors such as Trump’s crypto-friendly policies, institutional capital, and increasing adoption, Bitcoin is poised to maintain its leadership in the cryptocurrency market.

However, achieving stability and sustainability requires overcoming challenges such as price volatility, regulatory uncertainties, and short-term market sentiment. In this context, investors should carefully evaluate strategies to harness the potential of this groundbreaking digital asset.