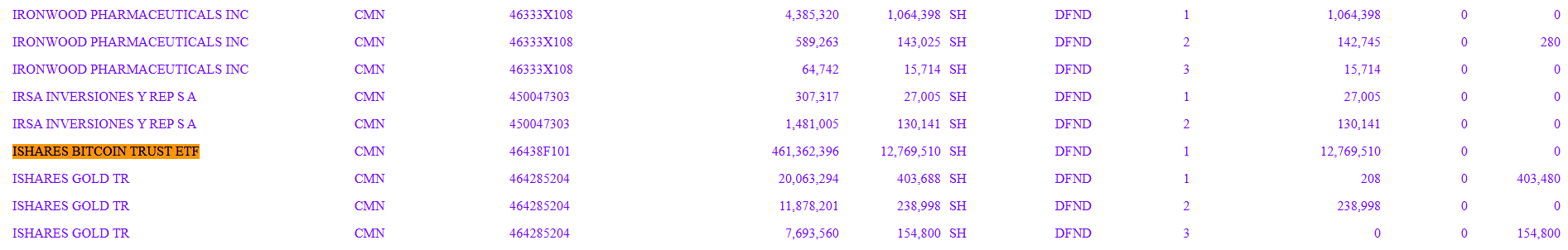

Goldman Sachs, one of the world’s leading financial institutions, has recently made a significant move to expand its digital asset portfolio by substantially increasing its stake in BlackRock’s iShares Bitcoin Trust (IBIT). According to a new filing submitted to the U.S. Securities and Exchange Commission (SEC) and first reported by MacroScope, Goldman Sachs now holds 12.7 million shares in this fund, with an estimated total value of $461 million. This marks an 83% increase from their previous position, when the bank held approximately 6.9 million shares.

Here's ads banner inside a post

Goldman Sachs’s move to expand its position in IBIT is not only a strategic step but also a clear indication of the financial institution’s belief in Bitcoin’s long-term growth potential within the global financial landscape. This event has placed Goldman Sachs as the second-largest investor in IBIT, trailing only Millennium Management, which holds approximately $844 million in IBIT shares. Goldman Sachs has now surpassed Capula Management, a company with a $253 million investment in IBIT, showcasing Goldman’s strong advancement in the race to hold Bitcoin ETFs.

Proactive Investment Strategy and Unique Portfolio Management

Goldman Sachs has not stopped at investing in IBIT; it has also broadened its portfolio with other Bitcoin ETFs. According to a recent report, Goldman Sachs currently holds over 1.7 million shares of Fidelity’s Wise Origin Bitcoin ETF (FBTC), valued at $95.5 million, marking a 13% increase since their previous report. Additionally, the bank has expanded its stake in Grayscale Bitcoin Trust (GBTC) to over 1.4 million shares valued at $71.8 million, a 116% increase since the last filing.

Moreover, Goldman Sachs holds 650,961 shares in Bitwise Bitcoin ETF (BITB), valued at an estimated $22.5 million, marking a 156% increase from their prior position. This expansion not only diversifies Goldman’s portfolio but also allows them to adopt innovative investment strategies and capitalize on the growth of the cryptocurrency market.

Here's ads banner inside a post

Goldman Sachs’ Comprehensive and Diverse Bitcoin Investment Portfolio

Goldman Sachs’s portfolio is not limited to Bitcoin ETFs from BlackRock, Fidelity, and Grayscale; it also includes stakes in ETFs managed by renowned companies such as Invesco/Galaxy, WisdomTree, and Ark/21Shares. This demonstrates Goldman Sachs’s long-term commitment to building a comprehensive digital asset portfolio that leverages the diversity of Bitcoin-related financial products.

As one of the world’s largest investment banks, Goldman Sachs has the advantage not only in market analysis but also in forecasting and shaping new investment trends. With its role as an authorized participant for BlackRock in distributing the Bitcoin ETF, Goldman Sachs is increasingly serious and prepared to become an integral part of the cryptocurrency ecosystem.

The Role and Impact of Goldman Sachs in the Bitcoin ETF Market

Goldman Sachs’s significant increase in Bitcoin ETF holdings also greatly impacts the development and acceptance of digital assets. With its longstanding reputation and scale, Goldman Sachs acts as more than just an investor; it serves as a bridge between digital assets and traditional investors. Its involvement in funds such as IBIT, FBTC, and GBTC helps enhance the liquidity and transparency of the Bitcoin market, enabling smaller investors and other institutional investors to enter this market more easily and safely.

Here's ads banner inside a post

Furthermore, the participation of large financial institutions like Goldman Sachs in Bitcoin investments also raises public awareness and confidence in Bitcoin and other digital assets. Amid a still-volatile market, Goldman Sachs’s actions may generate a positive ripple effect, encouraging other investors to approach Bitcoin ETF products.

Goldman Sachs’s Future Outlook and Development Strategy

With substantial investments in Bitcoin, Goldman Sachs is preparing for a future where digital assets will play a crucial role in institutional investors’ portfolios. The bank’s investment strategy is not simply about profit-seeking; it is also an effort to become a vital part of the digital asset market’s growth.:max_bytes(150000):strip_icc()/INV_GoldmanSachsSign_GettyImages-1638089906-d71fc24134d84262a12e05c2c5fea179.jpg)

In the near future, as regulatory clarity improves and financial products related to cryptocurrencies become more widely accepted, experts predict that Goldman Sachs will continue expanding its portfolio with other digital asset products such as Ethereum ETFs and potentially ETFs based on other cryptocurrencies.

Conclusion: A Promising Future for Goldman Sachs and the Bitcoin Market

With its growing investments in Bitcoin and Bitcoin ETFs, Goldman Sachs is steadily solidifying its pioneering role in the digital asset sector. Its strategic moves not only reinforce investors’ trust in Bitcoin’s future but also open significant opportunities for the digital asset market as more major financial institutions join this space.

In a period where the cryptocurrency market is rapidly evolving, Goldman Sachs exemplifies the shift from traditional to digital assets, with the hope of providing safer and more efficient investment opportunities for global investors. This also paves the way for a new future, where digital assets will not only be a trend but will become an essential part of the global financial landscape.