In a dynamic landscape where consumer finance is rapidly evolving, Affirm, a leading player in the buy now, pay later (BNPL) arena, has recently reported fiscal first-quarter results that have not only met but exceeded Wall Street expectations. This financial technology company, renowned for its innovative payment solutions, is showcasing remarkable growth, driven by strategic partnerships and an expanding user base. Let’s explore the impressive numbers behind Affirm’s success, the factors contributing to its growth, and what the future holds for this trailblazer in consumer finance.

Here's ads banner inside a post

Unpacking the Financial Results

Affirm’s fiscal first-quarter financial performance has been nothing short of remarkable. The company reported an adjusted loss per share of 31 cents, significantly better than the anticipated 35 cents loss projected by analysts. This narrower loss reflects the company’s effective management strategies and operational efficiencies. Revenue figures also tell a compelling story: Affirm posted $698 million in revenue, surpassing analyst expectations of $664 million.

One of the standout metrics was Gross Merchandise Volume (GMV), which reached $7.6 billion—this figure not only exceeded the average estimate of $7.28 billion but also marked a 35% increase compared to the previous year. GMV is a critical metric for assessing the total value of transactions facilitated through Affirm’s platform, indicating robust consumer engagement and increased adoption of BNPL services.

Here's ads banner inside a post

The company’s year-over-year growth is further underscored by a 41% increase in total revenue from $496.5 million a year earlier. This dramatic growth highlights Affirm’s ability to capture market demand effectively. Revenue less transaction costs (RLTC) came in at $285 million, comfortably exceeding prior guidance of $265 million to $280 million. This strong performance in RLTC demonstrates Affirm’s ability to manage its costs effectively while driving revenue growth.

A Clear Path to Profitability

As the financial landscape becomes increasingly competitive, Affirm is setting its sights on profitability. The company has projected that it will achieve profitability on a Generally Accepted Accounting Principles (GAAP) basis by the fourth quarter of 2025. This ambitious target reflects the management’s confidence in the scalability of Affirm’s business model and its capacity to navigate operational challenges.

Here's ads banner inside a post

In a recent communication to shareholders, CEO Max Levchin reinforced the company’s commitment to reaching operating profitability by the end of the fiscal year. This focus on profitability aligns with investor expectations, especially in a sector where sustainable growth is becoming increasingly important.

For the upcoming fiscal second quarter, Affirm has set revenue guidance between $770 million and $810 million, with a midpoint of $790 million, which is slightly below the average analyst estimate of $785 million. Analysts closely monitor such forecasts as they provide insights into a company’s growth trajectory and operational strategy. Additionally, the company forecasts GMV to be between $9.35 billion and $9.75 billion, compared to the analysts’ consensus of $9.48 billion. These projections indicate a strategic approach to growth, focusing on sustainable and manageable expansion.

Strategic Alliances: The Key to Expansion

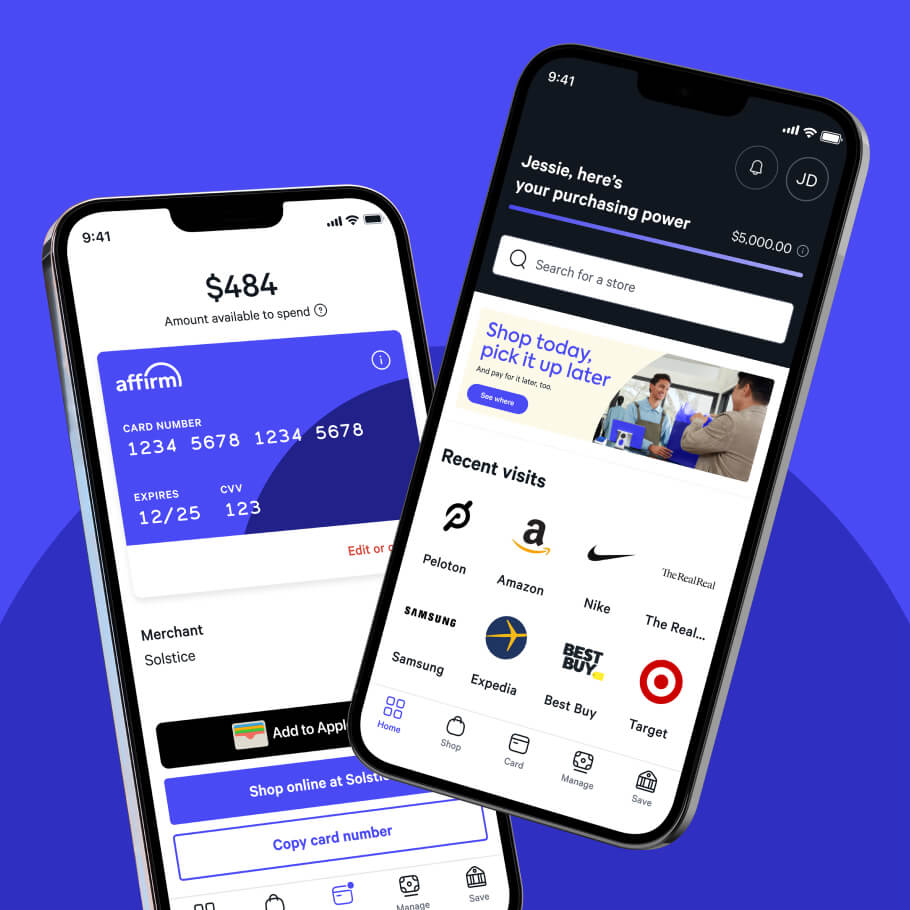

Affirm’s recent financial successes can be attributed, in large part, to its strategic partnerships with industry giants. Notably, the collaboration with Apple allows U.S. Apple Pay users on iPhones and iPads to seamlessly apply for loans through Affirm. This integration significantly enhances user engagement and convenience, allowing customers to access credit directly through their devices.

This partnership not only broadens Affirm’s market reach but also integrates its services into the daily lives of millions of Apple users. Furthermore, Affirm’s collaboration with Apple is a clear indication of the growing acceptance and demand for BNPL solutions among consumers who prefer flexible payment options for their purchases.

Additionally, partnerships with Amazon and Shopify are further strengthening Affirm’s position in the marketplace. By integrating with these major platforms, Affirm is not only reaching a larger audience but also enabling merchants to offer flexible payment solutions at checkout. This accessibility is pivotal in enhancing customer engagement with BNPL options, allowing Affirm to tap into the extensive customer bases of these established platforms.

Analyst Kevin Kennedy from Third Bridge remarked, “Affirm’s growth story has continued, particularly as they add new strategic distribution partners.” This insight highlights the critical role that partnerships play in Affirm’s ongoing success and market penetration. With these alliances, Affirm is better positioned to compete against other fintech companies that offer similar services, thereby solidifying its leadership in the BNPL space.

Standing Out in a Competitive Market

As the BNPL sector matures, the competitive landscape becomes increasingly crowded, raising concerns about commoditization. However, Affirm is effectively differentiating itself through its rigorous underwriting process and its focus on higher-value transactions. This approach is crucial in maintaining a competitive edge in a market where numerous players are vying for consumer attention.

By catering to interest-bearing BNPL purchases, Affirm has created a unique niche that offers greater security compared to lower-priced, generic BNPL offerings. This focus on larger ticket items positions Affirm favorably against a growing list of competitors, including Block, which acquired BNPL firm Afterpay for a staggering $29 billion in 2021. The competition is fierce, but Affirm’s commitment to quality underwriting and strategic partnerships provides a solid foundation for continued success.

Navigating Market Challenges and Opportunities

Despite its impressive growth, Affirm faces several challenges that could impact its future performance. Regulatory scrutiny of the BNPL sector has been increasing, with concerns regarding consumer debt and the potential for predatory lending practices. Affirm must navigate these regulatory hurdles while maintaining its commitment to responsible lending. The company has implemented stringent underwriting standards, which have helped mitigate risks and ensure that consumers are provided with loans they can afford.

Additionally, as more companies enter the BNPL space, Affirm must continually innovate to stay ahead of the competition. The fintech industry is characterized by rapid technological advancements, and companies that fail to adapt may quickly lose their market share. Affirm’s investment in technology and data analytics will be critical in enhancing customer experience and optimizing loan underwriting processes.

Looking Ahead: Opportunities and Growth Potential

As Affirm gears up for its quarterly earnings call scheduled for 5:00 p.m. ET, stakeholders will be keenly interested in the company’s future outlook and strategies. With shares trending upwards—up more than 70% since late August—investor confidence is on the rise. Affirm’s growth trajectory reflects broader trends in consumer finance, where flexibility and convenience in payment options are becoming paramount.

The future looks promising for Affirm as it continues to expand its partnerships and enhance its service offerings. The increasing acceptance of BNPL solutions among consumers indicates a growing market opportunity. As more retailers adopt Affirm’s payment solutions, the potential for increased transaction volume and revenue growth becomes evident.

Conclusion: A Bright Future Awaits

Affirm’s fiscal performance illustrates the strength of its operational framework and strategic foresight. With clear pathways to profitability and a growing portfolio of strategic alliances, the company is well-positioned to navigate the complexities of the financial landscape. As the BNPL sector continues to grow, Affirm’s focus on quality underwriting and innovative partnerships will be essential in shaping its future success.

The upcoming earnings call promises to provide deeper insights into how Affirm plans to capitalize on its current momentum and further enhance its market position. Investors and consumers alike will be watching closely as this financial technology pioneer continues to transform the consumer credit landscape. Affirm’s ability to adapt and innovate in a rapidly changing environment will ultimately determine its success in the competitive world of fintech.