A Legacy at Risk

In the rapidly evolving world of technology, where innovation drives success, few companies have managed to maintain a consistent lead like Samsung Electronics. Once the undisputed champion of the semiconductor industry, Samsung now faces a daunting challenge: a staggering $126 billion loss in market value as it struggles to keep pace with competitors like SK Hynix. This article explores the factors that led to Samsung’s decline in the wake of the AI boom and examines the path forward for the South Korean giant.

Here's ads banner inside a post

A Historical Overview: Samsung’s Reign in Semiconductors

For decades, Samsung was synonymous with semiconductor excellence. Dominating the memory chip market, the company enjoyed a comfortable lead over rivals, including SK Hynix and Micron Technology. Samsung’s advanced manufacturing capabilities and strong market presence positioned it to capitalize on burgeoning technologies, particularly in artificial intelligence (AI) and machine learning.

Here's ads banner inside a post

However, as AI applications such as OpenAI’s ChatGPT gained traction, the demand for specialized hardware surged, shifting the focus from traditional memory chips to high-bandwidth memory (HBM). This transition proved critical for the AI industry’s infrastructure, which necessitated faster and more efficient data processing capabilities.

The Rise of HBM: A New Frontier in Memory Technology

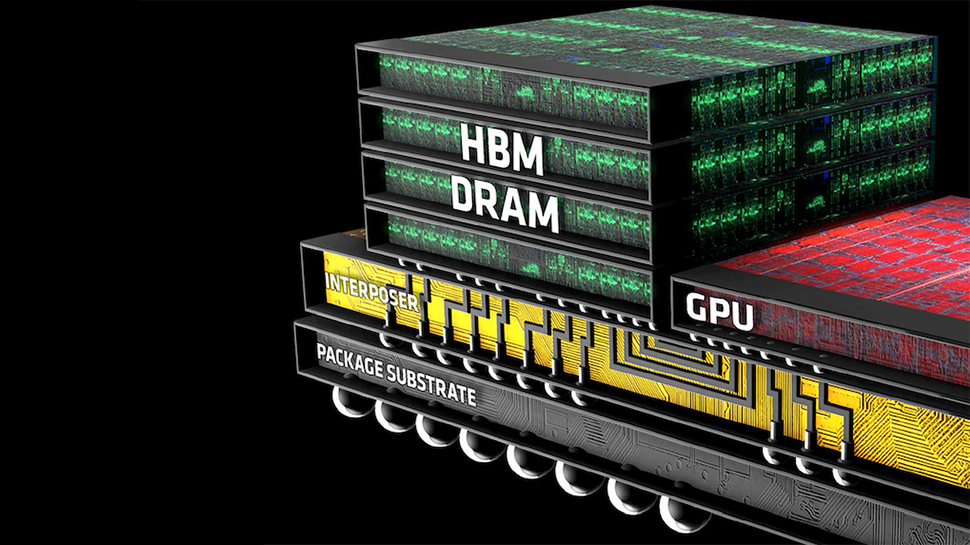

High-bandwidth memory (HBM) is a revolutionary development in semiconductor technology, designed to meet the growing demands of AI and data-intensive applications. By stacking multiple DRAM chips, HBM significantly enhances data transfer speeds and efficiency, making it ideal for use in advanced AI models.

Here's ads banner inside a post

While HBM had previously been viewed as a niche product, the AI boom catalyzed its adoption. Companies like Nvidia, a leading player in AI hardware, began to rely heavily on HBM to power their cutting-edge GPUs. Unfortunately for Samsung, the company underestimated the potential of HBM, opting not to invest sufficiently in its development.

Missed Opportunities: Samsung’s Strategic Oversight

Samsung’s decision to overlook the HBM market was a critical misstep. Kazunori Ito, director of equity research at Morningstar, remarked, “Samsung has not focused its resources on HBM development, believing the high costs were unjustified given the market’s size.” This conservative approach left the door wide open for competitors like SK Hynix, which quickly seized the opportunity.

:quality(80)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/282b2162-1222-486e-a4e7-38f2e9ac8bf7.jpg)

By aggressively investing in HBM technology and establishing a close partnership with Nvidia, SK Hynix secured its position as a leader in this burgeoning market. As a result, while Samsung struggled to gain traction, SK Hynix posted record quarterly profits, capitalizing on the growing demand for AI-ready chips.

The Fallout: A Financial Crisis Unfolds

The implications of Samsung’s HBM oversight have been profound. The company’s market value plummeted by $126 billion, reflecting the severe investor backlash and concerns over its diminishing competitiveness. In a rare move, Samsung’s executives issued a public apology for the company’s disappointing financial performance, acknowledging the urgency of addressing its strategic miscalculations.

As Samsung grappled with its financial woes, it became clear that the company was not merely dealing with a temporary setback but was facing a broader crisis of innovation and adaptability.

![News] Samsung Establishes New HBM Team to Advance HBM3, HBM3e and HBM4 Development | TrendForce News](https://img.trendforce.com/blog/wp-content/uploads/2024/07/05101856/Samsung-HBM-624x398.jpg)

Nvidia’s Gatekeeper Role: The Path to Redemption

At the heart of Samsung’s potential recovery lies its relationship with Nvidia. To become an approved supplier of HBM for Nvidia’s systems, Samsung must navigate a stringent qualification process—a hurdle it has yet to overcome. Without Nvidia’s endorsement, Samsung’s chances of reclaiming its position in the AI hardware market remain uncertain.

Analysts stress the critical nature of this approval, as Nvidia controls over 90% of the AI chip market. Brady Wang, an associate director at Counterpoint Research, noted, “Nvidia’s approval is essential for Samsung to benefit from the robust demand for AI servers.” Thus, Samsung’s future hinges on its ability to secure this vital partnership.

Glimmers of Hope: Samsung’s Strategic Initiatives

Despite the challenges, there are signs of hope for Samsung. The company recently announced significant progress in its HBM3E product line, with mass production reportedly underway. Furthermore, Samsung is actively working on its next-generation HBM4, targeting a launch in the second half of 2025. These developments signal a renewed commitment to innovation and a potential path toward recovery.

Samsung’s spokesperson highlighted that the company is making “meaningful progress” in its HBM initiatives, suggesting that it is not entirely out of the race yet. With its historical strengths in research and development, Samsung has the potential to catch up to SK Hynix, provided it can execute its plans effectively.

Reimagining Strategy: Lessons for the Future

To regain its stature in the semiconductor market, Samsung must learn from its missteps. The company needs to reassess its strategic priorities and invest in emerging technologies that align with market trends. The AI boom is not a fleeting phase; it represents a fundamental shift in how technology is integrated into daily life, and Samsung must adapt accordingly.

Investing in HBM technology is just one aspect of a broader strategy. Samsung should also focus on strengthening its partnerships within the industry, particularly with leading AI firms and hardware developers. Collaborating with innovators can foster a culture of creativity and agility, essential for navigating the fast-paced tech landscape.

A Critical Juncture for Samsung

As Samsung Electronics faces a critical juncture in its history, the company must confront the realities of its current situation with resolve. The fall from grace in the semiconductor industry serves as a stark reminder of the importance of foresight and adaptability in technology.

The road to recovery will not be easy, but with strategic investments in innovation, a renewed focus on HBM, and strengthened industry partnerships, Samsung can potentially reclaim its position as a leader in the semiconductor market. The company’s journey ahead is fraught with challenges, but if history teaches us anything, it is that resilience and adaptability can pave the way for a successful comeback in the ever-evolving world of technology.