According to Fortune, Bernard Arnault, the owner of the luxury goods conglomerate LVMH, has recently seen his personal wealth evaporate by $10 billion in just one day after the company’s stock price plummeted 7% due to a surprising drop in Q3 2024 sales. LVMH, which owns iconic brands such as Louis Vuitton, Dior, and Tiffany, is facing significant challenges as demand for luxury goods, particularly from the Chinese market, shows signs of slowing down.

Here's ads banner inside a post

For Arnault, this news is far from pleasant. Just 18 months ago, he was the richest man in the world, with his wealth reaching record highs when LVMH’s stock was at its peak. However, since then, the total market capitalization of LVMH has dropped by $163 billion, while Arnault’s personal fortune has diminished by $37 billion. He has now fallen to the fifth position on the global rich list, becoming the billionaire who has lost the most money in recent times.

In its latest report, LVMH announced that Q3 sales had decreased by 3% compared to the previous year, reaching only $21 billion. Arnault’s personal wealth is currently estimated at around $174.5 billion, significantly lower than other tech giants whose assets have grown at double-digit rates over the past year. This figure is drastically lower than at the beginning of 2024, when Arnault still held the title of the richest billionaire in the world. In March 2024, his total personal wealth hit a record high of $231 billion, only to plummet sharply due to declining sales.

In September 2024, Bernard Arnault fell to the fifth position in the world’s richest list after a 20% drop in stock prices, leading to a net worth decrease of $54 billion.

Here's ads banner inside a post

Is Luxury on the Decline?

In the first half of 2024, LVMH reported a slight decrease in revenue, but numerous signs indicate that the growth momentum of the luxury goods sector is no longer what it used to be. The wine and spirits division of LVMH experienced significant sales declines due to weak demand from the Chinese market.

“Perhaps given the current global situation, from economic to geopolitical perspectives, no one is keen to buy expensive bottles of wine. I’m not sure, but the reality is our sales have dropped by double digits,” lamented Jean-Jacques Guiony, CFO of LVMH.

Here's ads banner inside a post

Worse still, the fashion and leather goods division—LVMH’s core segment and a global indicator for the luxury sector—recorded its first sales decline since 2020. According to LVMH, the main reason for this downturn is weak consumer spending in the Chinese market, which led to a drop in Q3 sales, compounded by a series of economic and geopolitical uncertainties worldwide.

Guiony stated that it remains unclear whether recent stimulus measures from the Chinese government will be enough to boost spending in the region. LVMH’s sales in Asia, excluding Japan, decreased by 16% in Q3, a more significant drop than expected and marking the third consecutive quarter of decline for the company.

Chinese consumer confidence is at a record low due to concerns over risks in the real estate market and high unemployment rates, which have heavily impacted luxury goods purchases. “Consumer confidence in China is currently at an all-time low, similar to the Covid-19 pandemic period,” Guiony noted.

A year ago, the contribution rates from the U.S. and Asian markets to LVMH’s sales were 24% and 32%, respectively. However, these figures have now dropped to 25% and 29%, indicating a decline in Chinese buyers.

Moreover, the ongoing U.S.-China trade conflict has posed challenges for LVMH, as many of its luxury brands are tied to both markets. Even in Arnault’s home country of France, LVMH faces the risk of having to pay an additional €800 million in taxes if the French government passes a new tax bill aimed at reducing budget deficits.

Clearly, the billionaire who was once the richest man in the world at the beginning of 2024 is having a tough year.

Career Overview

Reflecting on Arnault’s career, the French billionaire started working at his father’s real estate company in 1971. By 1975, he persuaded his father to sell the construction division to focus solely on real estate.

Arnault’s career took a significant turn when he invested $15 million from the sale of the construction division in 1975 to acquire luxury brands such as Christian Dior and Boussac Saint-Frères in 1984. Immediately after the acquisition, Arnault laid off 9,000 veteran employees working for these fashion brands, sold off most assets (except for the Dior brand), and earned the nickname “the destroyer.”

However, Arnault’s tough approach proved effective as the fashion segment began to turn a profit by 1987, generating $1.9 billion in revenue with a net income of $112 million. That same year, Arnault partnered with Alain Chevalier (CEO of Moët Hennessy) and Henry Racamier (Chairman of Louis Vuitton) to establish LVMH, which has since developed into the world’s largest luxury conglomerate.

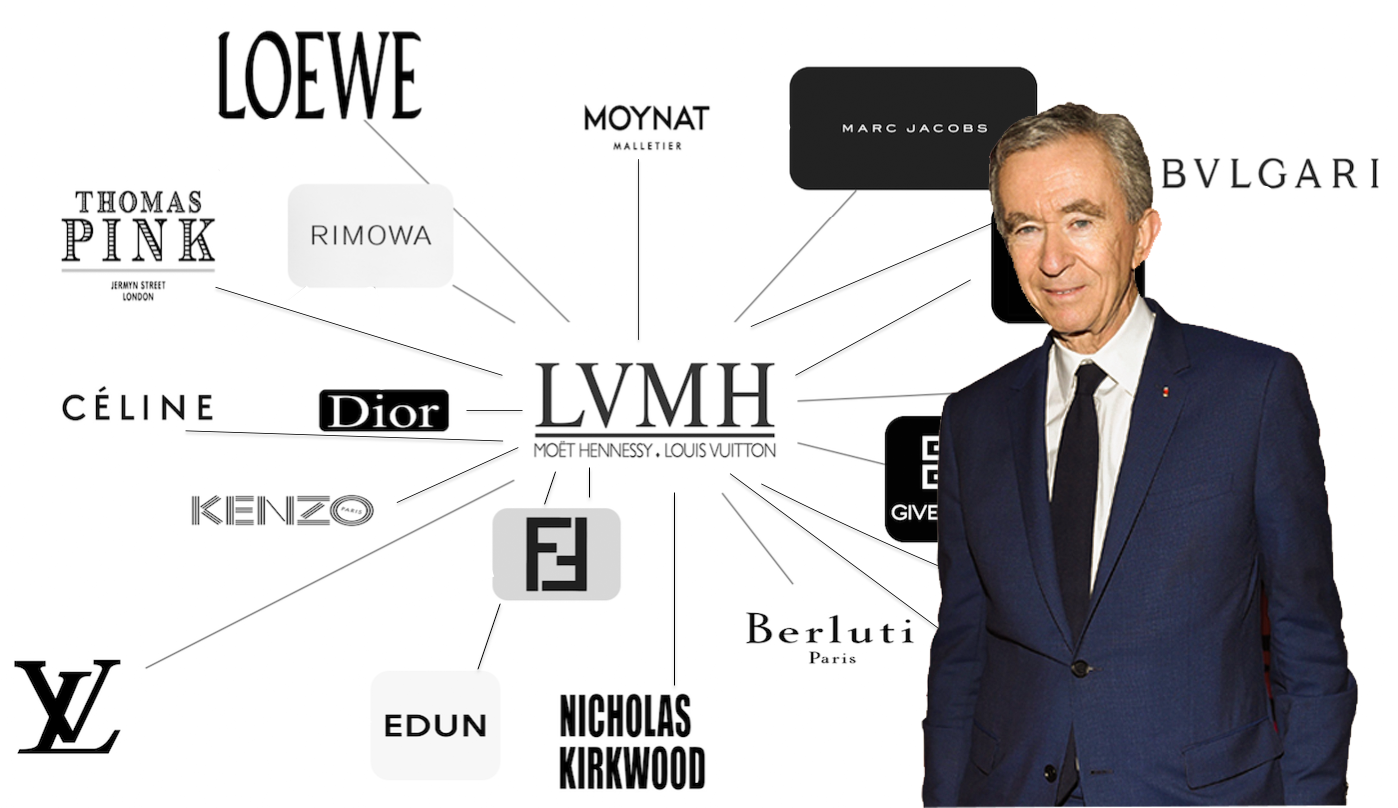

Today, LVMH boasts approximately 75 luxury brands within its portfolio and has evolved into the largest publicly traded company in Europe. In early 2024, LVMH became the first European company to surpass the $500 billion mark, and Arnault’s wealth also crossed the $200 billion threshold for the first time.

Currently, all five of Arnault’s children work within LVMH brands and are competing to one day inherit their father’s luxury empire. However, Arnault shows no signs of stepping down; he has pushed the board to amend regulations to extend the retirement age for the chairman and CEO positions from 75 to 80 years, allowing him to stay on longer.

Amid the current upheaval, Bernard Arnault’s journey is not just a story of wealth but also one of challenges faced by a man who has built the largest luxury empire in the world. This journey is sure to continue, with many surprises awaiting ahead.