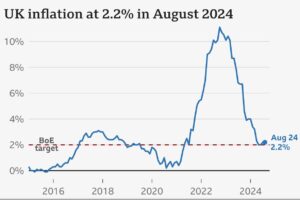

Lord Mervyn King, former Governor of the Bank of England, stated that the recent record inflation was primarily caused by the central bank keeping interest rates too low for too long. He also criticized other central banks for not acting quickly enough to control the situation from the start.

Here's ads banner inside a post

In an interview with BBC Radio Four’s Broadcasting House, ahead of next month’s budget announcement, Lord King said inflation is now under control, but the process should have started sooner. He added that “there are bound to be some changes” to fiscal rules in the near future.

Lord King also didn’t shy away from criticizing the previous government’s decision to cut national insurance contributions, and he suggested that the current Labour Party should reverse that decision. According to him, the policy was not only a mistake by the former government, but Labour’s commitment not to reverse it is equally irresponsible.

When asked if the Bank of England had kept interest rates too low for too long, Lord King responded frankly: “Yes, and that’s why we had inflation.”

Here's ads banner inside a post

However, he emphasized that the Bank of England had begun raising interest rates, just like other central banks around the world. “Rates have been raised, and inflation is now under control,” he added. Currently, according to him, interest rates are in the “right ballpark.”

At its most recent meeting in September, the Bank of England decided to keep the base interest rate at 5%, which directly affects mortgage rates, credit card rates, and savings rates. The next meeting is scheduled for November, and many are waiting to see if there will be any changes to monetary policy.

On the topic of the budget, Lord King predicted that the government would take some “half measures” because it has committed to both public sector investment and spending limits. As such, he believed the government might need to tweak some of those restrictions.

Here's ads banner inside a post

He argued that the national debt-to-national income ratio is the correct metric by which to assess whether the economy is on a sustainable path. However, he criticized the idea of forecasting this ratio over a five-year period, calling it ungrounded and unreasonable. Instead, Lord King suggested, “the right thing to do would be to commit to reducing the debt-to-income ratio by the end of this Parliament, at a fixed date.”

Finally, Lord Mervyn King expressed disappointment with the Labour Party for deciding not to reverse the previous government’s cut to national insurance contributions. He felt that this cut was not only an irresponsible move by the former government, but that Labour’s pledge not to undo it was equally blameworthy.

“I don’t understand why the previous government cut national insurance contributions,” Lord King said. “I think it was irresponsible, and for the then-opposition, now government, to promise not to reverse that is just as irresponsible.”