Here's ads banner inside a post

Dwayne ‘The Rock’ Johnson’s Big Financial Win: The $41 Million TKO Stock Move You Didn’t See Coming

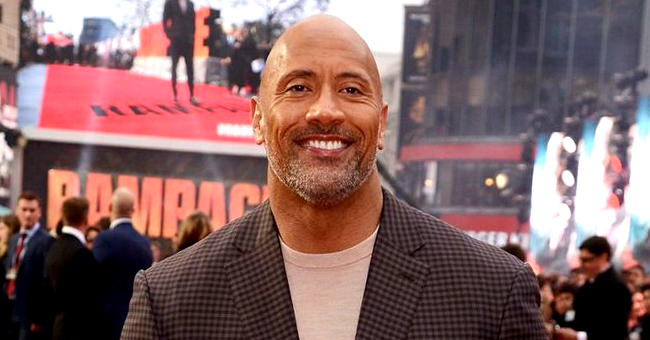

Dwayne “The Rock” Johnson has long been a symbol of success, whether it’s in the wrestling ring, on the big screen, or in the business world. Known for his charisma, larger-than-life persona, and relentless work ethic, Johnson has built an empire that spans beyond entertainment. From starring in blockbuster films like Fast & Furious and Jumanji to his entrepreneurial ventures with brands like Teremana Tequila and ZOA Energy, Johnson’s business acumen has proven to be as formidable as his acting skills. But it’s his latest financial move—an eye-popping $41 million gain from his TKO stock that has everyone talking—that shows just how shrewd the 51-year-old superstar is when it comes to investments.

This unexpected financial triumph through his involvement in TKO Group Holdings Inc., a major player in the sports and entertainment industry, reveals the depth of Johnson’s business strategy. It’s a story that combines not just celebrity wealth but also savvy, timing, and a deep understanding of both the entertainment world and the stock market. If you think this is just another case of a celebrity jumping on a stock bandwagon, think again. Let’s break down the $41 million TKO stock move and why it’s far more significant than you might have realized.

Here's ads banner inside a post

What is TKO Group Holdings?

Before diving into the details of Dwayne Johnson’s involvement with TKO Group Holdings, it’s important to understand exactly what the company is and why it’s been making headlines. TKO Group Holdings is a recently formed sports and entertainment conglomerate that emerged from the merger of WWE (World Wrestling Entertainment) and UFC (Ultimate Fighting Championship), two of the world’s most successful and profitable sports entertainment organizations. This massive merger, finalized in 2023, created a powerhouse with a combined valuation of over $20 billion.

The merger allowed the newly formed TKO Group to leverage the massive global fanbases and lucrative media rights deals of both the UFC and WWE, along with new revenue-generating opportunities through sponsorships, live events, and global broadcasting agreements. This merger not only reshaped the landscape of combat sports but also set the stage for TKO Group Holdings to become an even larger force in the global entertainment market.

The company went public soon after the merger, offering shares to investors and allowing them to buy stock in what was seen as a potentially lucrative opportunity. Enter Dwayne Johnson.

Here's ads banner inside a post

Dwayne Johnson’s Investment in TKO: A Savvy Business Move

Dwayne Johnson’s connection to TKO Group Holdings goes beyond just casual interest in the wrestling world. In fact, Johnson has been deeply involved in WWE for decades, starting with his iconic wrestling career as “The Rock.” His long history with the organization made him an important figure in its brand identity, and he remains a beloved legend within the wrestling community. However, Johnson’s involvement with TKO is not just about nostalgia—it’s a calculated investment decision.

Johnson, through his company Seven Bucks Productions (which he co-founded with his ex-wife Dany Garcia), made a significant investment in the newly formed TKO Group Holdings during its IPO (Initial Public Offering). The Rock didn’t just buy stock as a fan of WWE or UFC; he saw an opportunity to capitalize on the growing intersection of sports, entertainment, and media in a company poised for big things in the coming years. Johnson’s extensive network within the entertainment and sports industries also positioned him as an ideal figure to leverage the potential of TKO Group’s merged assets.

His decision to buy into TKO was not only strategic in terms of market trends but also closely tied to his understanding of consumer culture. Johnson has long been aware of the power of branding, storytelling, and fan engagement—core pillars of both WWE and UFC. As a savvy businessman, he recognized that the newly formed company would likely see significant appreciation in value as it continued to grow, particularly with the backing of two beloved, high-profile brands that already had strong global followings.

$41 Million in Gains: How Did He Pull It Off?

The $41 million financial windfall that Dwayne Johnson is celebrating today is a direct result of the success of TKO Group Holdings’ stock performance following its IPO. While stock market fluctuations are a natural part of any investment, the combination of Johnson’s inside knowledge of the brands and his ability to strategically time his investments allowed him to profit handsomely.

The stock price of TKO Group Holdings saw a substantial increase soon after it went public, fueled by investor excitement surrounding the merger. UFC’s global popularity and WWE’s well-established fan base, combined with the leadership of high-profile figures like Vince McMahon and Dana White, created a perfect storm of interest from both institutional investors and retail investors alike. TKO Group’s diverse revenue streams—pay-per-view events, global merchandise sales, live broadcasts, and media rights—made it an attractive proposition, and the market quickly recognized its potential.

Johnson’s involvement as a major stakeholder in TKO only heightened the company’s visibility. As a high-profile public figure, Johnson’s endorsement of the company carried weight, boosting investor confidence. His brand and social media presence—coupled with his history of successful ventures in both entertainment and business—ensured that TKO Group’s stock became even more appealing to investors who were eager to follow the lead of such a successful figure.

In the weeks following the IPO, TKO Group Holdings stock surged, and Johnson’s stake in the company grew significantly. His $41 million windfall, which came through the increase in the value of his shares, is a testament to his sharp business instincts. While Johnson didn’t share the exact number of shares he purchased or the timing of his initial investment, it’s clear that he had a deep understanding of how both WWE and UFC would perform after the merger. It’s also worth noting that Johnson’s Seven Bucks Productions has a history of making smart moves in the entertainment industry, including his involvement in ventures like the XFL and his production company’s deal with Netflix.

Why This Is More Than Just a “Celebrity Investment”

Dwayne Johnson’s $41 million win in TKO stock isn’t just another celebrity investing in a trendy company—it’s a prime example of how entertainment and business are increasingly intertwined. For years, celebrities have leveraged their fame and visibility to make strategic investments, but few have done so with the level of success and understanding that Johnson has.

Where many celebrity investments can feel superficial or rooted in brand promotion, Johnson’s involvement in TKO Group Holdings is a deeply informed business move that reflects his understanding of the market, the power of global media, and the potential for growth in the sports entertainment sector. Unlike other celebrities who dabble in investments without fully understanding the industry, Johnson has built a reputation as a savvy businessman who knows how to identify lucrative opportunities.

Additionally, Johnson’s connection to both the wrestling and fighting worlds gives him a unique vantage point. He’s not just another investor looking for a quick buck; he’s someone who has lived the world of WWE and UFC and knows firsthand the tremendous potential both organizations have in terms of entertainment, fan loyalty, and global appeal. As a result, his financial win is a validation of his ability to see the bigger picture, even in industries as volatile as entertainment and sports.

The Bigger Picture: Dwayne Johnson’s Business Strategy

While his $41 million gain from TKO Group Holdings is certainly impressive, it’s part of a much larger business strategy that has made Dwayne Johnson one of the most financially successful and diversified stars of his generation. Johnson’s career has always been marked by his ability to balance multiple ventures, and his involvement in TKO Group is just one example of his broader approach to wealth-building.

Johnson’s Seven Bucks Productions, which has produced successful films, television shows, and digital content, continues to grow, allowing him to leverage his platform as an entertainer into a larger media empire. The Rock’s ability to negotiate deals that place him in the driver’s seat—whether as a producer, actor, or investor—has led to a series of smart financial decisions. His investments in tech, fitness, and wellness, alongside his media ventures, create a diversified portfolio that allows him to ride the wave of shifting consumer trends.

Johnson has also shown a remarkable understanding of global markets. His involvement in TKO is just one facet of a larger strategy to position himself as a key player in industries that are driven by fan loyalty and mass appeal. Whether it’s through his tequila brand Teremana or his social media empire, The Rock’s ability to build businesses that resonate with audiences is unparalleled.

TKO and the Future of Sports Entertainment

As TKO Group Holdings continues to grow and evolve, it’s clear that the company’s future is bright. The merger of WWE and UFC has already resulted in significant synergies, with the combined entity poised to dominate the global sports and entertainment landscape. The rise of digital platforms, new media distribution models, and live streaming offers fresh opportunities for growth, making TKO Group an exciting prospect for both investors and fans alike.

For Dwayne Johnson, the $41 million he made from his TKO stock is a reflection of his deep understanding of the market and his strategic foresight. But it’s also an example of how he has transformed from just an entertainer into a powerful businessman who can identify opportunities before they hit the mainstream.

In the coming years, Johnson’s role within TKO Group may expand even further, and his business portfolio will likely continue to diversify. One thing is certain: Dwayne “The Rock” Johnson isn’t just playing in Hollywood anymore—he’s playing the game on a global scale, and his $41 million win in TKO is only one of many successful moves to come.