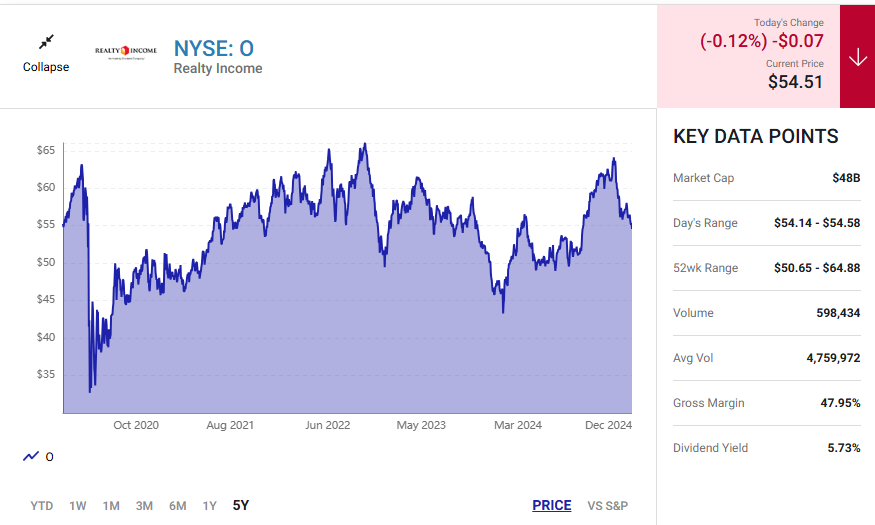

Realty Income (NYSE: O) could be on the brink of a major comeback in 2025. After years of battling higher interest rates and stagnant investor sentiment, this real estate investment trust (REIT) is well-positioned for growth thanks to stabilizing market conditions, falling interest rates, and its attractive dividend yield. With a proven track record of success and financial stability, Realty Income is ready to shine as one of the most promising income stocks for the upcoming year.

Here's ads banner inside a post

Realty Income’s Business Remains Resilient

Realty Income, known as “The Monthly Dividend Company,” operates under a unique net lease model for single-tenant commercial properties. Under this structure, tenants are responsible for taxes, insurance, and maintenance costs, which keeps Realty Income’s operations lean and profitable.

Despite the challenging economic climate caused by high interest rates in recent years, Realty Income continued to thrive. It expanded its property portfolio significantly, including the 2024 acquisition of Spirit Realty Capital, which added over 2,000 properties to its holdings. Today, Realty Income boasts approximately 15,500 properties with a remarkable 99% occupancy rate—a clear sign of the company’s strength and stability in the real estate market.

Falling Interest Rates Could Be a Game Changer

Over the past few years, higher interest rates have negatively impacted REITs like Realty Income. Rising borrowing costs made it more expensive to acquire and develop properties, putting pressure on profit margins. However, with the Federal Reserve signaling lower interest rates for 2025, Realty Income could see significant improvements in profitability.

Here's ads banner inside a post

Lower rates are a huge catalyst for REITs, as they:

- Reduce borrowing costs, increasing margins and cash flow.

- Attract yield-hungry investors looking for stable, high-dividend-paying stocks.

Realty Income’s attractive 5.7% dividend yield is already more than 4.5 times higher than the S&P 500’s average dividend yield of 1.2%. As rates fall, more investors are likely to view Realty Income as a compelling investment, driving up demand for its stock.

Strong Financials and Growth Prospects

Realty Income’s financial performance has remained solid despite economic headwinds. In the first nine months of 2024, the company reported a 31% increase in revenue to $3.9 billion, largely driven by the Spirit Realty acquisition.

Here's ads banner inside a post

While net income rose by just 1% during the same period, the more critical measure for REITs—funds from operations (FFO)—surged 27% year over year to $2.7 billion. This metric provides a clearer picture of Realty Income’s cash flow and operating health, showcasing the company’s ability to generate consistent returns.

Analysts predict 6% revenue growth in 2025, aligning with Realty Income’s historical averages. Combined with its robust portfolio expansion and occupancy rates, this growth projection reinforces the REIT’s long-term value.

A Dividend Powerhouse

One of Realty Income’s standout features is its commitment to delivering reliable income to shareholders. Since its first dividend payout in 1994, the company has consistently raised its dividend at least once per year. In the past 12 months alone, management has increased the monthly payout five times, with an annualized dividend of $3.17 per share.

At today’s share price, this translates to a 5.7% yield, making Realty Income one of the most attractive income plays on the market. For investors seeking passive income, this dividend yield—combined with the stock’s stability and growth potential—makes Realty Income a top pick heading into 2025.

Valuation Remains Attractive

Although Realty Income’s P/E ratio of 53 may appear high, it’s important to remember that REIT earnings are impacted by large non-cash expenses like depreciation. This can skew net income lower and make the P/E appear inflated.

Instead, investors look to the price-to-FFO ratio for a more accurate valuation. Realty Income currently trades at a P/FFO ratio of 14, signaling an undervalued stock relative to its performance and growth potential. With falling interest rates on the horizon, this undervaluation may not last long.

Why 2025 Could Be Realty Income’s Year

Realty Income has weathered economic uncertainty and emerged stronger than ever. As interest rates decline, the company’s combination of:

- A 5.7% dividend yield

- A 99% occupancy rate

- Consistent FFO growth

- An attractive valuation

…creates a perfect storm for recovery and investor interest in 2025.

This REIT’s proven ability to acquire and manage properties, deliver reliable income, and navigate challenging market conditions sets it apart as a long-term winner. For investors looking for a balance of income and growth, Realty Income stock may be one of the smartest plays for the year ahead.

Final Thoughts

With its resilient business model, record of dividend growth, and improving economic tailwinds, Realty Income is poised for a strong 2025. As interest rates fall and investor demand rises, this undervalued REIT has the potential to deliver significant returns while continuing to reward shareholders with one of the most reliable dividends on the market.

Don’t miss this opportunity to add Realty Income (O) to your portfolio and capitalize on its strong fundamentals and compelling value proposition.