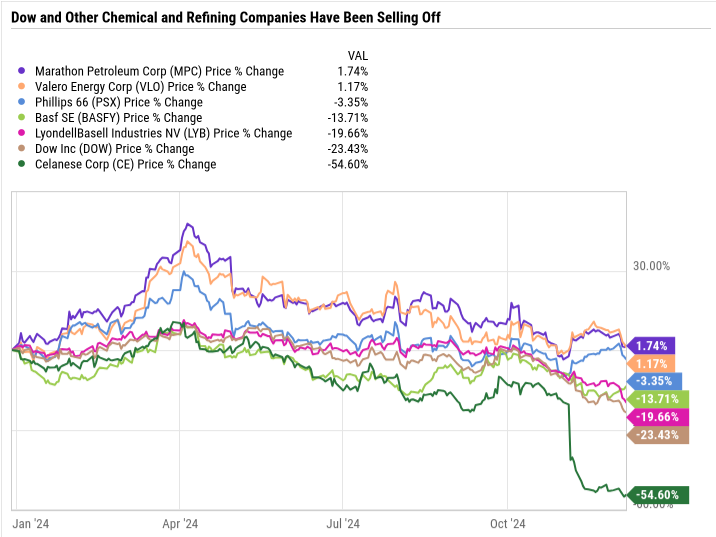

Dow Inc. (NYSE: DOW), a global leader in commodity chemicals, is experiencing a challenging year. With its stock down 23% year-to-date and 13% in the last month alone, many investors are wondering if now is the time to buy. The sell-off has pushed Dow’s dividend yield to an attractive 6.7%, making it a tempting prospect for income-focused investors. Despite current headwinds, Dow’s leadership position and consistent dividend make it worth a closer look.

Here's ads banner inside a post

Challenges Facing Dow

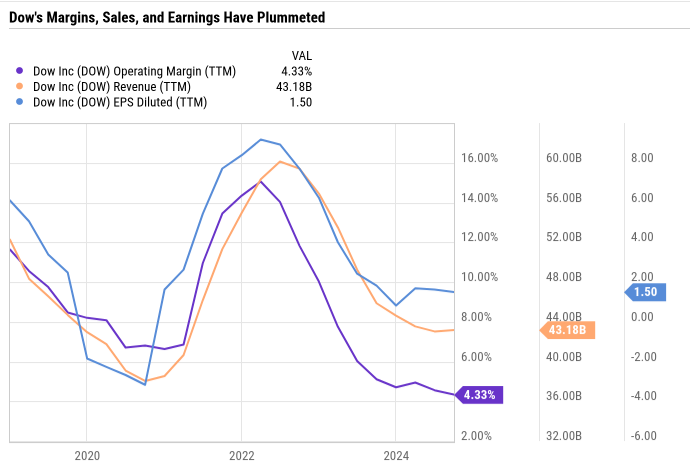

Dow operates across three segments: packaging and specialty plastics, industrial intermediates and infrastructure, and performance materials and coatings. Like many commodity-driven businesses, Dow’s fortunes are tied to global economic conditions and fluctuating prices. Unfortunately, the company is facing multiple challenges:

- Global Slowdown: Demand for chemical products has weakened, particularly in Europe and China. European markets, in particular, are struggling due to regulatory uncertainty and soft demand. Dow CEO James Fitterling recently highlighted these issues, stating that Europe’s regulatory landscape is creating significant hurdles for the industry.

- High Competition: Increased competition from Chinese manufacturers has added pressure on margins.

- High Interest Rates: Rising rates are impacting global manufacturing and production, making it harder for Dow’s customers to finance purchases or expand operations. Additionally, higher rates increase Dow’s borrowing costs, given its $19.4 billion debt load.

These factors have taken a toll on Dow’s margins, which are now at their lowest levels since the company became an independent entity in 2019. The Federal Reserve’s commitment to maintaining higher interest rates for longer has further fueled concerns, contributing to the stock’s recent decline.

Why Dow Still Deserves Attention

Despite its challenges, Dow remains an industry leader with a strong history of weathering economic cycles. Here’s why the stock could be a compelling opportunity for patient investors:

Here's ads banner inside a post

- Stable Dividend: Dow has consistently paid a quarterly dividend of $0.70 per share since its 2019 spinoff. With a current yield of 6.7%, the stock offers an attractive income stream for investors. If you were to buy Dow at its current price of $42 per share and hold for five years, you would earn $14 per share in dividends—equating to a yield on cost of over 33%. This makes the stock appealing for those seeking passive income.

- Industry Leadership: Dow is a key player in the global chemicals market and has demonstrated resilience during downturns. While margins are currently under pressure, the company’s ability to adapt and optimize costs positions it well for a recovery when market conditions improve.

- Valuation: At a depressed share price, Dow presents a potential value opportunity. Long-term investors who can withstand short-term volatility may benefit as the industry cycle turns.

- Solid Financials: While debt levels remain high, Dow’s financial ratios, including its debt-to-equity and debt-to-capital ratios, are within a reasonable range. The company also maintains an investment-grade BBB credit rating, indicating adequate capacity to meet its financial commitments.

The Long-Term Case for Dow

Dow’s current struggles are largely driven by external factors affecting the entire chemicals industry. Unlike companies facing self-inflicted challenges, Dow’s issues stem from broader economic conditions, making the stock’s decline more about timing than underlying weakness.

Investing in Dow requires a long-term perspective. Timing industry cycles is notoriously difficult, but those willing to wait three to five years could see margins and earnings rebound. As the company generates excess cash, it can pay down debt and further strengthen its balance sheet. In the meantime, its stable dividend offers a compelling incentive for income-focused investors.

A Balanced Approach for Investors

Dow isn’t without risks. Prolonged economic slowdowns, particularly in Europe, or sustained high interest rates could delay a recovery. However, for investors who value income and are comfortable with volatility, Dow offers an opportunity to lock in a high yield at a discounted price.

Here's ads banner inside a post

Buying leading companies during industry-wide downturns has historically been a successful strategy for patient investors. Dow’s strong position in the chemicals market, combined with its attractive dividend, makes it a stock worth considering for those looking to add a high-yield investment to their portfolio.

Final Thoughts

Dow’s current struggles may deter some investors, but its high dividend yield and long-term potential offer a compelling case for those willing to ride out the storm. As economic conditions stabilize, Dow is well-positioned to recover, rewarding investors with both income and potential capital appreciation. For income seekers and value investors alike, Dow could be a high-yield gem waiting to shine.