Eli Lilly (NYSE: LLY) has strengthened its case for investment with compelling new data from a late-stage clinical trial. Already a leader in the cardiometabolic medicine space, the pharmaceutical giant has unveiled findings that solidify its competitive edge against Novo Nordisk (NYSE: NVO), a formidable rival. Here’s why this new information makes Eli Lilly’s stock an even more enticing prospect for investors.

Here's ads banner inside a post

A Game-Changing Clinical Trial

The key revelation stems from a head-to-head phase 3b clinical trial comparing Eli Lilly’s anti-obesity drug, Zepbound (tirzepatide), with Novo Nordisk’s Wegovy (semaglutide). For years, speculation swirled over which drug was more effective. Now, the results are in, and Zepbound has emerged as the clear winner.

The trial showed that after 72 weeks of treatment, patients using Zepbound lost an average of 20.2% of their body weight, compared to only 13.7% for those on Wegovy—a staggering 47% improvement. Furthermore, 31.6% of Zepbound patients achieved at least a 25% reduction in total body weight, while only 16.1% of Wegovy users hit the same benchmark.

These findings represent a significant advantage for Eli Lilly in capturing market share, as physicians are likely to favor a drug that demonstrates superior efficacy. Unlike other considerations such as side effects—which are similar between the two drugs—effectiveness will be a decisive factor in prescribing habits.

Here's ads banner inside a post

Why It Matters for Investors

For investors, these results mean that Zepbound could dominate the growing anti-obesity drug market, which is expected to reach tens of billions of dollars in the coming years. Already a blockbuster, Zepbound generated $1.2 billion in sales in Q3 of 2024, despite being on the market for less than a year and facing initial supply constraints.

With the trial results likely to boost demand, analysts estimate that the new data could contribute an additional $100 million in quarterly revenue over the next few years. While the full economic impact may not materialize until the second half of 2025, the long-term potential is massive.

A Stronger Competitive Position

Eli Lilly’s success with Zepbound strengthens its position against Novo Nordisk, another powerhouse in the field. The competition between these two companies has intensified as both vie for dominance in the lucrative anti-obesity market.

Here's ads banner inside a post

Novo Nordisk’s Wegovy was first to market and has been widely recognized for its effectiveness, but Zepbound’s superior results in this trial could tilt the scales. This newfound advantage allows Lilly to attract more prescribers without significantly increasing marketing spend, giving the company a strategic edge.

Risks and Valuation Concerns

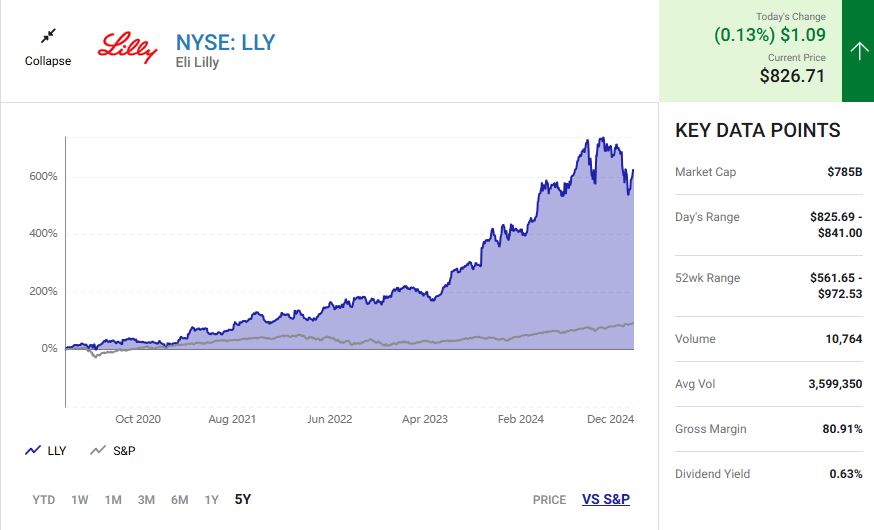

Despite the bullish outlook, potential investors should exercise some caution. At its current price of $826.71 per share, Eli Lilly is trading at a trailing 12-month price-to-earnings (P/E) ratio of 87.6, far above the market average of 29.1.

This high valuation reflects high expectations for the company’s future earnings growth. While Zepbound is poised to deliver robust performance, a disappointing quarter or unexpected hurdle could lead to a sharp pullback in the stock price.

That said, Eli Lilly’s track record of innovation and its strong pipeline of drugs suggest that the company has the capacity to meet these lofty expectations over time. Investors should view the current valuation as a premium for entering a leader in a high-growth market.

Broader Implications for Eli Lilly

Eli Lilly’s leadership in obesity treatment is only one part of its larger story. The company has a diversified portfolio of therapies targeting diabetes, cancer, and other diseases, contributing to its position as a pharmaceutical juggernaut with a market capitalization of $785 billion.

Moreover, the company’s gross margin of 80.91% and consistent dividend payouts make it an attractive option for investors seeking a blend of growth and stability.

The Bottom Line: A Stock Worth Watching

Eli Lilly’s latest trial results provide a compelling reason for investors to take notice. With Zepbound demonstrating unparalleled efficacy and the anti-obesity market poised for significant expansion, the stock offers strong growth potential.

However, given its high valuation, it’s wise to invest with a degree of restraint. This stock isn’t cheap, but its long-term prospects make it a worthy addition to any growth-focused portfolio.

As always, diversification is key. While Eli Lilly is a standout performer, even the strongest stocks are subject to market fluctuations. For those ready to invest, this could be a rare opportunity to align with a leader in one of healthcare’s most promising sectors.

Don’t Miss Out

Eli Lilly’s winning formula in the fight against obesity highlights the company’s innovative edge and strategic prowess. For investors, it’s a chance to ride the wave of a transformational market, one that promises not only financial returns but also profound improvements in global health outcomes.