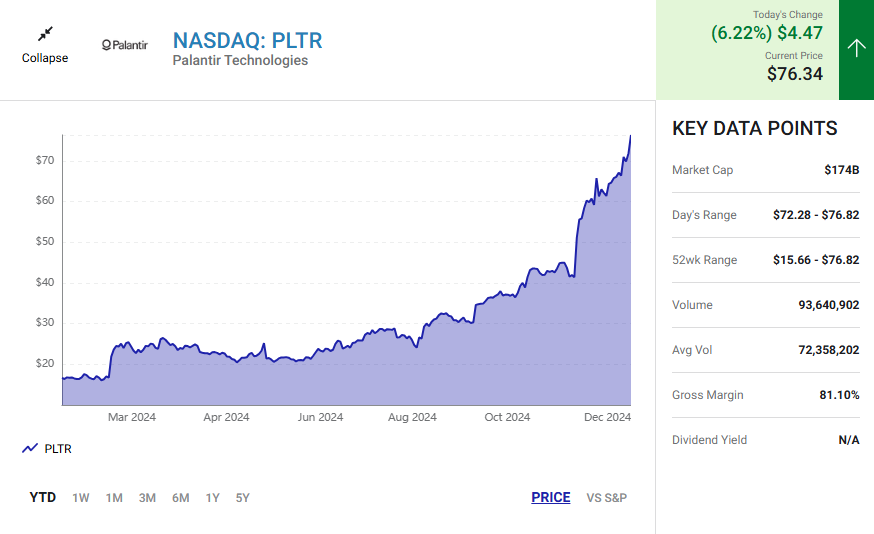

Palantir Technologies (NASDAQ: PLTR) has had a remarkable year, with its stock soaring by more than 280%. Known for its data analytics software that powers both commercial and government clients, the company has positioned itself as an early leader in the artificial intelligence (AI) boom. With its innovative Artificial Intelligence Platform (AIP) launched just last year, demand has skyrocketed, driving revenue and profit growth to record levels.

Here's ads banner inside a post

As investors marvel at Palantir’s explosive gains, the big question arises: Is it too late to invest in this AI powerhouse, or does the stock still have room to grow?

A Growth Story Backed by AI

Palantir has long been a staple in government contracts, helping agencies process and utilize data to make impactful decisions. However, the company’s pivot toward commercial business has accelerated its growth trajectory. In just four years, Palantir expanded its U.S. commercial customer base from 14 to nearly 300.

The company’s AIP has been a major driver behind this success. The platform allows clients to harness AI to streamline operations, cut costs, and even develop new products. This surge in demand has resulted in double-digit revenue growth, with U.S. commercial revenue climbing 54% year-over-year in the most recent quarter and U.S. government revenue rising by 40%.

Here's ads banner inside a post

A Broader AI Opportunity

The AI market is projected to grow from $200 billion today to a staggering $1 trillion by the end of the decade. Palantir, with its head start and proven technology, is well-positioned to capture a significant share of this expanding market.

In the latest quarter, Palantir closed over 100 deals valued at more than $1 million each, highlighting the increasing scale of its operations. This growth reflects the company’s ability to cater to large-scale clients across both public and private sectors.

Challenges in Valuation

While Palantir’s business fundamentals are robust, its current stock valuation raises concerns. The company is trading at 175 times forward earnings estimates, which is steep even for a high-growth stock. Wall Street analysts have taken note of this, with most maintaining a “hold” recommendation and forecasting a potential 40% drop in the stock over the next 12 months.

Here's ads banner inside a post

This cautious outlook isn’t a reflection of Palantir’s business potential but rather the premium investors are paying for the stock today. Such a high valuation may limit its near-term upside, making it less attractive for those seeking immediate gains.

What Wall Street Thinks

Despite its lofty valuation, analysts recognize Palantir’s long-term potential. The consensus is that Palantir is on a path of sustained growth, thanks to its dominance in AI and expanding customer base. Over time, as earnings catch up to the stock’s valuation, Palantir could once again deliver outsized returns.

For investors focused on the long haul, Palantir remains an intriguing option. Its leadership in the rapidly growing AI sector positions it as a stock with significant upside over the years, even if near-term performance may be tempered by current valuations.

Is It Time to Buy?

The decision to invest in Palantir boils down to your investment strategy:

- For Growth Investors: If you’re willing to ride out short-term volatility in favor of long-term gains, Palantir could be a worthwhile addition to your portfolio. Its leadership in AI and proven ability to scale its business make it a standout in the tech space.

- For Value-Oriented Investors: Palantir’s high valuation may deter those looking for immediate value. In this case, waiting for a potential dip in the stock price could present a better entry point.

The Path Ahead

Palantir’s meteoric rise this year has solidified its status as a key player in the AI revolution. While Wall Street remains cautious about its near-term performance due to valuation concerns, the company’s strong fundamentals and massive addressable market suggest a bright future.

For investors who believe in the transformative power of AI and are willing to adopt a long-term perspective, Palantir offers an opportunity to be part of a revolutionary growth story. Whether or not to buy now depends on your risk tolerance and investment horizon, but the company’s potential to reshape industries with AI makes it hard to ignore.