Palantir Technologies Inc. (NYSE: PLTR) has been one of 2024’s standout performers, riding the wave of artificial intelligence (AI) to a jaw-dropping 290.7% year-to-date (YTD) gain. With its cutting-edge Artificial Intelligence Platform (AIP) revolutionizing how businesses tackle challenges like supply chain disruptions and inefficiencies, the Denver-based company has cemented its place as a leader in the AI-driven transformation of industries. But as the stock enters 2025 at sky-high valuations, can Palantir maintain its incredible momentum?

Here's ads banner inside a post

The Catalysts Behind Palantir’s Meteoric Rise

2024 has been a landmark year for Palantir. One of the most significant boosts to the stock came in September, when the company joined the prestigious S&P 500 Index, elevating its profile and attracting institutional investors. Additionally, Palantir recently moved its listing from the NYSE to the Nasdaq, aligning itself with tech giants like Apple and Meta. This strategic shift positions the company for potential inclusion in the Nasdaq-100 Index, which could further bolster its market visibility and attract funds tracking the index.

Adding to the buzz, Palantir’s stellar third-quarter earnings report sent its stock soaring 23% in early November. Revenue jumped 30% year-over-year to $725.5 million, with adjusted earnings per share (EPS) of $0.10 surpassing Wall Street expectations. The company’s U.S. operations were a standout, with commercial revenue surging 54% and government contracts rising 40%. CEO Alex Karp described the performance as “eviscerating the quarter,” emphasizing the unrelenting demand for AI-powered solutions.

Palantir’s AI Revolution and Growth Prospects

At the heart of Palantir’s success is its AIP, which seamlessly integrates generative AI into business operations, empowering organizations to make smarter, data-driven decisions. The platform has become indispensable across sectors, from defense and finance to manufacturing and healthcare.

Here's ads banner inside a post

The company is doubling down on its AI-driven growth. For fiscal 2024, Palantir raised its revenue guidance to $2.805 billion-$2.809 billion, driven by an expected 50% increase in U.S. commercial revenue. Analysts project Palantir’s GAAP earnings to grow 162.5% year-over-year in 2024, with another 42.9% climb anticipated in 2025.

However, the AI hype comes at a cost. Palantir’s valuation has soared to 174.4 times forward earnings and 53.8 times sales—far above the tech sector median and the company’s five-year historical average. While investors are clearly betting on future growth, such lofty valuations raise questions about whether the stock can sustain its trajectory.

A Balancing Act: CEO Insider Sales and Wall Street Sentiment

In November, CEO Alex Karp made headlines by selling $556 million worth of Palantir shares across three tranches under a Rule 10b5-1 plan. While these sales were pre-planned and don’t necessarily signal a lack of confidence in the company, they did raise eyebrows among investors. Karp’s plan allows for the sale of up to 9 million additional shares through May 2025, which could temporarily cap the stock’s upside.

Here's ads banner inside a post

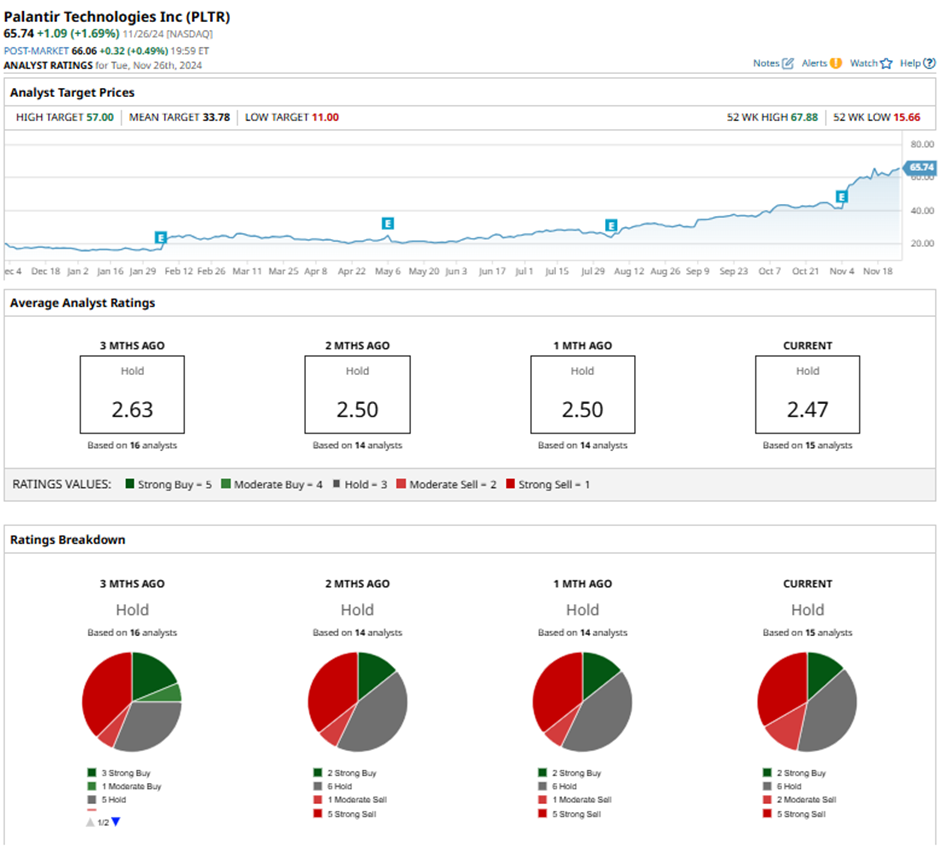

Wall Street remains divided on Palantir. Jefferies has an “Underperform” rating and a bearish price target of $28, citing concerns about the stock’s inflated valuation. In contrast, BofA Securities and Wedbush have taken a bullish stance, raising their price targets to $75 on optimism surrounding Palantir’s potential to digitize industries and drive AI innovation.

Overall, the consensus among analysts is cautious. Of the 15 analysts covering the stock, two rate it a “Strong Buy,” six recommend a “Hold,” and seven advise various levels of “Sell.”

Challenges and Opportunities in 2025

Palantir’s continued success depends on its ability to maintain its leadership in AI and expand its customer base across industries. The company’s balance sheet is a strong advantage, with $4.6 billion in cash and a 58% operating cash flow margin in Q3 2024. This financial flexibility allows Palantir to invest aggressively in innovation and growth.

However, challenges loom. The competitive landscape in AI and data analytics is becoming increasingly crowded, with tech giants and startups vying for market share. Additionally, Palantir’s reliance on government contracts, which account for a significant portion of its revenue, could expose it to geopolitical risks and changes in public spending priorities.

What’s Next for Palantir Stock?

As 2025 approaches, Palantir’s story is one of immense potential and equally significant risks. While the company’s cutting-edge AI solutions and strong financial performance position it as a key player in the AI revolution, its sky-high valuation leaves little room for error.

For long-term investors, Palantir’s innovative approach and robust growth prospects make it a compelling option. However, those wary of volatility or inflated valuations may want to wait for a more attractive entry point.

Whether Palantir can sustain its momentum into 2025 will depend on its ability to execute on its ambitious growth plans while navigating the challenges of an evolving market. For now, Palantir remains one of the most fascinating—and polarizing—stocks in the tech sector.