Warren Buffett, one of the most successful investors in history, has long been known for his strategy of buying great businesses at fair prices. Despite his reluctance towards tech stocks in the past, Amazon (AMZN) has become one of the standout holdings in his Berkshire Hathaway portfolio. Even though it wasn’t initially Buffett’s idea to buy Amazon, he has since admitted that it was a mistake not to purchase the stock sooner. With its impressive track record and growing prospects, now might be the perfect time to consider adding Amazon to your own portfolio—especially if you have $500 to invest.

Here's ads banner inside a post

Buffett’s Reflection on Amazon’s Potential

Buffett has openly discussed how he missed the boat on Amazon earlier in the company’s history. “I don’t have a good answer,” he confessed about why he didn’t buy Amazon earlier. Over 20 years after the company went public, Buffett acknowledged his mistake and said, “It’s one I missed big time.” Despite his initial hesitation towards tech stocks, which don’t fit neatly into his traditional investment framework, Amazon has proven to be much more than just a tech company. It is a global leader in e-commerce, cloud computing, advertising, and, most recently, artificial intelligence (AI).

While Buffett’s investment style generally focuses on businesses with strong fundamentals and predictable cash flows, Amazon’s diverse growth opportunities have made it an appealing investment. And now, as the stock trades at an attractive valuation, it’s an excellent opportunity for new investors, particularly if you’re working with a modest investment like $500.

Amazon’s Impressive Track Record

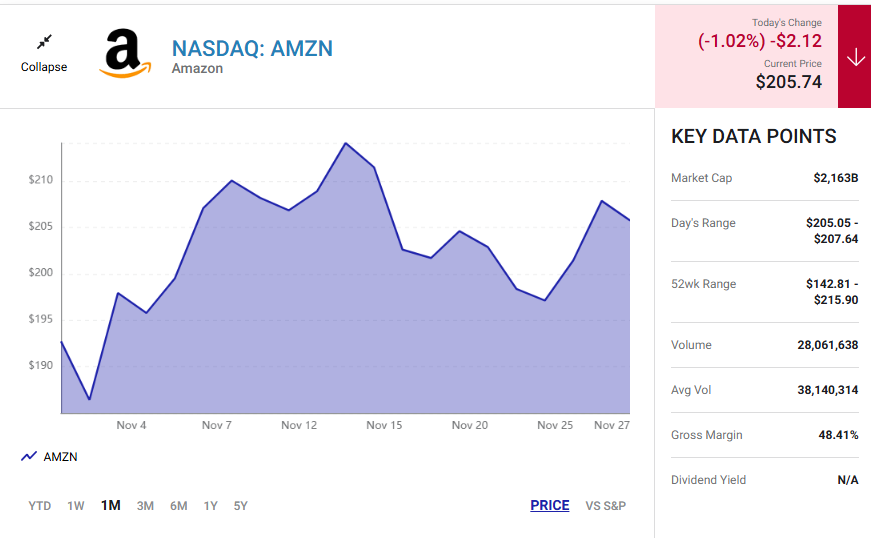

When Buffett first bought Amazon, it was already a huge player in retail and e-commerce. Since that time, the stock has soared 127% over the last five years, making it one of the most successful investments in his portfolio. Despite this growth, Amazon’s valuation remains reasonable by historical standards, which adds to its appeal as a potential buy. Trading at a P/E ratio of 43, Amazon might not be “cheap,” but considering its future growth potential, this is far from an inflated price.

Here's ads banner inside a post

With its stock split and continued momentum, Amazon’s stock price has stayed within a more accessible range for smaller investors. If you have $500 to invest today, buying a couple of shares of Amazon could be one of the smartest decisions you make, as the stock continues to offer substantial growth pot

Amazon’s Role in the AI Revolution

One of the key reasons Amazon is poised for continued success lies in its investments in artificial intelligence (AI). The company has integrated AI across nearly all of its operations—from improving its e-commerce logistics to revolutionizing advertising and cloud computing through Amazon Web Services (AWS). However, its most exciting opportunity lies in the development of generative AI, which is reshaping how businesses approach everything from data analysis to customer interactions.

Amazon’s generative AI platform, launched through AWS, has become a major revenue driver, and it’s just getting started. The company’s management has reported that it launched twice as many new services as all of its competitors combined in the past 18 months. As customers realize they cannot access Amazon’s cutting-edge AI technology without being on its cloud, AWS is experiencing renewed growth. In fact, AWS sales increased by 19% year-over-year in the third quarter, further demonstrating its huge potential.

Here's ads banner inside a post

This move into AI positions Amazon at the forefront of the tech industry, and with AI already bringing in billions of dollars, this segment could be one of the major contributors to the company’s growth in the coming years.

E-Commerce, Streaming, and Advertising: Amazon’s Diverse Revenue Streams

Amazon’s growth doesn’t stop at AI. The company continues to dominate the e-commerce space, innovating in new ways to stay ahead of competitors. From faster delivery systems to better customer experiences, Amazon remains a leader in online retail. But beyond its massive e-commerce platform, Amazon is also making significant strides in the streaming industry, competing against rivals like Netflix and Disney+.

Advertising is another high-growth area for Amazon, with the company’s ad business growing 19% year-over-year in Q3. The shift towards digital advertising has been a major boost to Amazon’s bottom line, as more and more advertisers seek to leverage Amazon’s massive user base and data insights. With its new ad-supported streaming tier, Amazon is unlocking even more value for advertisers.

These diverse revenue streams give Amazon a significant advantage over other companies that rely on a single business model. Amazon’s ability to innovate and expand into new markets ensures its continued relevance and profitability.

Why Amazon is an Attractive Buy Today

Amazon’s growth story is far from over. Even after rewarding investors with massive gains in the past, the company is well-positioned to continue its upward trajectory. The major growth drivers of AI, e-commerce, advertising, and cloud computing are all expanding rapidly, and Amazon is leading the charge.

While Amazon stock may not be the cheapest on the market, its long-term growth potential—combined with its relatively affordable valuation compared to its historical highs—makes it a compelling investment. If you have $500 to invest right now, purchasing a couple of shares of Amazon stock is a smart move that could pay off handsomely in the years to come.

In Conclusion: A Smart Investment for the Future

Warren Buffett’s decision to buy Amazon was a lesson in not underestimating a company with extraordinary potential. Despite initial hesitations, Amazon has become one of Buffett’s most successful investments, and it remains a top pick for anyone looking to invest in a company with sustained growth prospects. With its strong leadership in AI, e-commerce, and advertising, Amazon is a stock that offers both stability and exciting growth opportunities.

If you’re looking to put your $500 to work, Amazon is an excellent choice. While past performance is no guarantee of future results, Amazon’s diverse business model, innovative strategies, and leadership in emerging industries suggest that it will continue to thrive for years to come.