Marathon Digital (MARA), a leading Bitcoin mining company, has made waves in the cryptocurrency world this month with its massive Bitcoin acquisitions. In November alone, Marathon purchased 6,474 BTC, including an additional 703 BTC just last week, solidifying its position as a dominant corporate Bitcoin holder. With $160 million in cash reserves earmarked for future purchases, Marathon is poised to seize opportunities when Bitcoin dips, further strengthening its hold in the crypto market.

Here's ads banner inside a post

Expanding Bitcoin Reserves

As of November 27, Marathon Digital holds an impressive 34,794 BTC, valued at approximately $3.3 billion at current market prices. This makes the company the second-largest corporate Bitcoin holder globally, trailing only MicroStrategy, which has been aggressively acquiring Bitcoin throughout 2024.

Marathon’s Bitcoin holdings now account for 0.16% of Bitcoin’s finite supply, underscoring the company’s belief in Bitcoin as a critical hedge against inflation and currency devaluation. Marathon CEO Fred Thiel emphasized the importance of Bitcoin in corporate strategies during an interview with Yahoo Finance, stating, “Bitcoin is definitely something every company should have on its balance sheet.”

Strategic Funding and Smart Moves

Marathon’s latest Bitcoin purchases come on the heels of a successful $1 billion zero-interest convertible senior note sale. From the $980 million in net proceeds, the company allocated $200 million to repurchase a portion of its existing 2026 notes, ensuring financial flexibility for future investments. The remaining $160 million has been reserved to acquire more Bitcoin at opportune moments, a calculated strategy to maximize value.

Here's ads banner inside a post

Riding the Bitcoin Wave

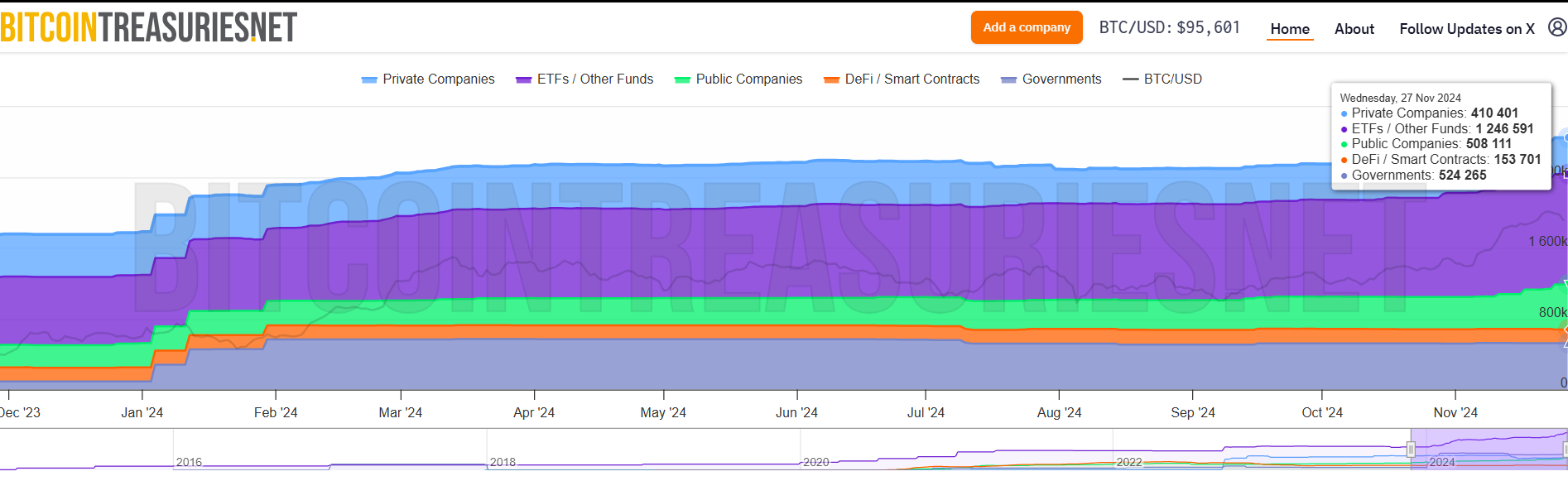

The acquisition spree aligns with a broader trend of public companies increasing their Bitcoin holdings. According to Bitcoin Treasuries data, corporate BTC reserves have grown from 272,774 BTC at the beginning of 2024 to 508,111 BTC by November, marking an explosive 86% increase.

Much of this growth is driven by aggressive buyers like MicroStrategy, which set records in November by acquiring over 130,000 BTC. Meanwhile, Marathon Digital’s disciplined and strategic approach to Bitcoin acquisitions further exemplifies the growing adoption of Bitcoin as a treasury asset among corporations.

Other Companies Joining the Bitcoin Race

The enthusiasm for Bitcoin is spreading rapidly, with several companies adopting Bitcoin treasury reserve strategies this month.

Here's ads banner inside a post

- Rumble’s Move Into Bitcoin: The video-sharing platform announced plans to allocate up to $20 million of its cash reserves to Bitcoin. This decision followed Rumble CEO Chris Pavlovski’s public support for Bitcoin, earning praise from Bitcoin evangelist Michael Saylor.

- Genius Group’s Big Bitcoin Bet: The AI-focused company acquired $14 million worth of Bitcoin earlier in November, committing to hold 90% or more of its reserves in Bitcoin. With a target of reaching $120 million in Bitcoin investments, Genius Group exemplifies the growing trend of businesses pivoting toward crypto as a primary asset.

Marathon’s Growing Influence

Marathon Digital’s impressive Bitcoin holdings reflect the company’s ambition to stay at the forefront of the cryptocurrency space. While its 34,794 BTC represents only a fraction of MicroStrategy’s dominance (1.8% of Bitcoin’s total supply), Marathon’s strategy to capitalize on market fluctuations demonstrates its forward-thinking approach.

The company’s stock has also benefited from its crypto-savvy moves. Shares of Marathon Digital rose nearly 8% on Wednesday and are up 14% year-to-date, signaling strong investor confidence in the company’s strategy.

Why Bitcoin Is the New Corporate Must-Have

The rise in corporate Bitcoin holdings reflects a growing consensus among businesses that Bitcoin’s finite supply and decentralized nature make it an ideal hedge against economic uncertainty. Public companies increasingly view Bitcoin not just as a speculative asset but as a cornerstone of their treasury strategies.

Marathon Digital’s CEO Fred Thiel summed up this sentiment, highlighting Bitcoin’s ability to preserve value amid inflationary pressures. As more companies adopt Bitcoin as a reserve asset, it’s clear that the cryptocurrency is becoming a critical tool for navigating an unpredictable economic landscape.

Looking Ahead

Marathon Digital’s latest Bitcoin purchases and its $160 million cash reserve signal the company’s commitment to strengthening its foothold in the crypto market. With Bitcoin adoption continuing to surge among corporations, Marathon is well-positioned to capitalize on future opportunities, further cementing its status as a key player in the industry.

As Bitcoin’s role in corporate finance grows, companies like Marathon are leading the charge, showing the world that cryptocurrency isn’t just a trend—it’s a strategic investment for the future.