When it comes to fintech, the landscape is vast and varied, encompassing everything from innovative banks to technology companies offering financial services. For investors, this diversity can make it challenging to pinpoint the best opportunities. However, if you have $1,000 to invest and are eyeing the fintech sector, Nu Holdings (NYSE: NU) is worth serious consideration. Here’s why this rising star in Latin America stands out.

Here's ads banner inside a post

A Fast-Growing Fintech Powerhouse

Nu Holdings, the parent company of Brazil-based Nubank, has rapidly established itself as one of the most promising fintech companies in the world. Offering an impressive range of services—including credit cards, checking and savings accounts, personal loans, crypto investments, and even cellphone plans—Nu has become a one-stop shop for its customers’ financial needs.

Since its founding a decade ago in Brazil, Nu Holdings has grown its customer base to an astonishing 110 million people across Brazil, Mexico, and Colombia as of the third quarter of 2024. This represents a 23% increase in customers compared to the same period last year.

In its home market of Brazil, Nu dominates the financial landscape, boasting the largest number of active credit card users. With more than half of Brazil’s adult population holding a Nubank account and 84% of those users actively engaging with the platform monthly, Nu has become a household name.

Here's ads banner inside a post

Nu’s international expansion has also been impressive. In Mexico, the company has already secured its position as the leading digital financial platform, with 9 million customers—a figure that grew by nearly 16% in the third quarter. In Colombia, Nu now serves 2 million customers, with growth accelerating in both markets. This regional dominance is a testament to the company’s ability to scale while maintaining customer satisfaction.

Strong Profitability and a Solid Foundation for Growth

Many fintech companies struggle to balance growth with profitability, but Nu Holdings has proven that it can deliver on both fronts. The company turned a net profit in 2021 and has continued to expand its margins, a rare achievement in the fintech sector.

In the third quarter of 2024, Nu’s revenue soared 58% year over year to $2.9 billion, and net income surged by 82% to $553 million. These numbers were supported by improving gross profit margins, which rose to 46%, up from 43% in the same quarter last year.

Here's ads banner inside a post

One of Nu’s key strengths lies in its efficient customer acquisition model. Management has emphasized that the cost of serving its customers remains low while generating a high return on equity from new accounts. This efficient approach to growth has allowed Nu to scale rapidly without sacrificing profitability.

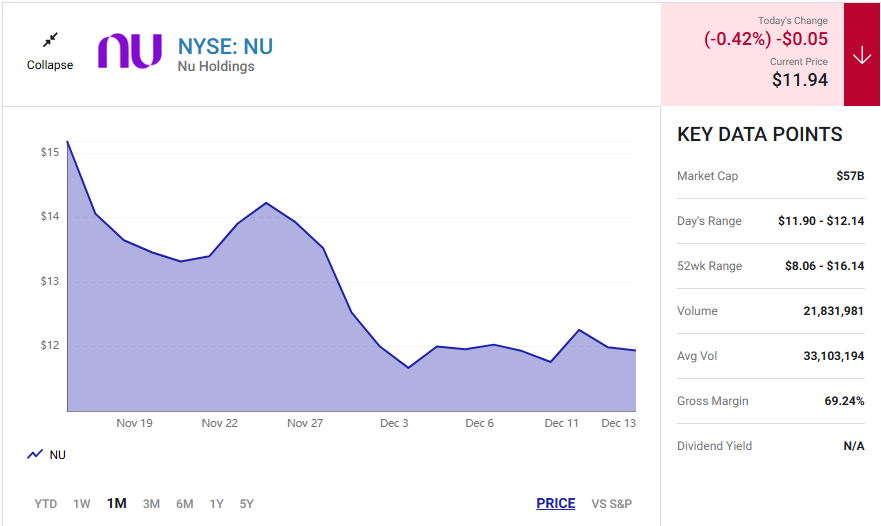

Valuation That Stands Out in the Fintech Crowd

Nu Holdings’ stock is priced at a price-to-earnings (P/E) ratio of 33, which might seem high at first glance. However, when compared to the broader market and its peers, Nu looks like a bargain. The S&P 500’s average P/E ratio is 30.9, while competitor SoFi Technologies trades at an eye-watering multiple of 133.

This relatively reasonable valuation, coupled with Nu’s strong revenue and profit growth, makes it an attractive choice for investors looking for a fintech stock with solid fundamentals and long-term potential.

The Bigger Picture: Why Nu Holdings is Worth Your $1,000

Nu Holdings is much more than a financial services provider—it’s a transformative force in the Latin American market. By offering accessible, affordable, and innovative financial solutions, the company has captured the trust of millions of customers and positioned itself as a leader in one of the world’s fastest-growing regions.

Its dominance in Brazil, successful expansion into Mexico and Colombia, and impressive financial performance all point to a company with a bright future. For investors, these attributes make Nu a compelling opportunity for long-term growth.

Risks to Consider

Like any investment, Nu Holdings comes with its risks. The company operates in emerging markets, which can be subject to economic volatility and regulatory changes. Additionally, while its international expansion is promising, competition from local and global players could pose challenges.

That said, Nu’s track record of innovation, customer satisfaction, and profitability suggests that it is well-equipped to navigate these risks and continue delivering strong returns.

Final Thoughts

If you’re looking to invest $1,000 in a fintech stock right now, Nu Holdings is a standout option. Its rapid growth, strong profitability, and reasonable valuation make it one of the best-positioned companies in the fintech space.

Whether you’re drawn by its dominance in Latin America, its commitment to innovation, or its ability to generate consistent profits, Nu offers a compelling case for long-term investors. As the company continues to expand and strengthen its foothold, it’s poised to deliver significant returns—and maybe even reshape the future of fintech.

Now might just be the perfect time to add Nu Holdings to your portfolio.