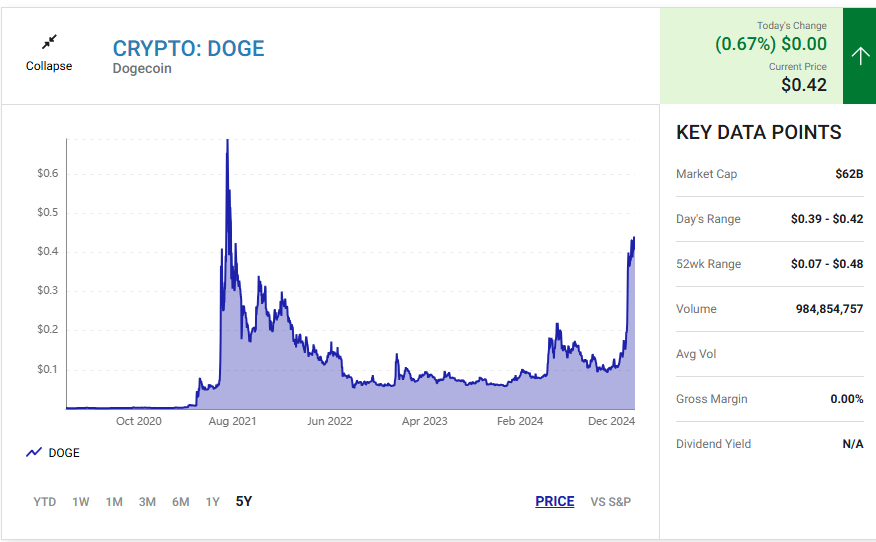

Dogecoin, the once-joke cryptocurrency, has taken the financial world by storm in 2024 with an astonishing 350% surge, far outpacing Bitcoin’s impressive 100% gain. As the total cryptocurrency market capitalization hits a record $3.5 trillion, Dogecoin’s momentum has reignited debates about its future and whether it could become a better investment than Bitcoin by 2025.

Here's ads banner inside a post

But while Dogecoin enjoys the spotlight, largely thanks to influential backers like Elon Musk and an incoming Trump administration, its sustainability remains questionable. Let’s break down the dynamics behind Dogecoin’s rally, its long-term potential, and whether Bitcoin still holds the crown.

The Trump-Musk Effect: Fueling Dogecoin’s Ascent

Dogecoin’s meteoric rise can be attributed to two major figures: Elon Musk and President-elect Donald Trump. Musk’s fascination with Dogecoin began in 2021, when he dubbed it his favorite cryptocurrency and propelled its value with social media endorsements. After spiking 15,769% that year to a record $0.73, Dogecoin eventually plummeted, losing 92% of its value by mid-2022.

The token languished until recently, but Trump’s presidential win in November 2024 gave it a fresh lease on life. Market speculation suggests that Trump’s administration will adopt a crypto-friendly stance, favoring lighter regulations that could fuel industry growth. Adding to the frenzy, Musk was named head of the newly established Department of Government Efficiency (DOGE)—a cheeky nod to the cryptocurrency. While there’s no indication Dogecoin will play a role in the new department, the association has stoked investor excitement, sending the token soaring to $0.42.

Here's ads banner inside a post

Dogecoin vs. Bitcoin: Fundamentals Matter

Despite its rally, Dogecoin remains a speculative asset without meaningful use cases. It’s still trading below its 2021 all-time high and struggles to gain traction as a widely accepted currency. According to Cryptwerk, only 2,515 merchants accept Dogecoin for payment, compared to 8,875 for Bitcoin.

Bitcoin, on the other hand, continues to break records, approaching the $100,000 mark per coin. Unlike Dogecoin, Bitcoin is increasingly viewed as “digital gold,” a secure store of value that’s gaining traction among institutions. The Securities and Exchange Commission (SEC) recently approved Bitcoin exchange-traded funds (ETFs), providing financial advisors and institutional investors with a regulated avenue for Bitcoin ownership.

Bitcoin, on the other hand, continues to break records, approaching the $100,000 mark per coin. Unlike Dogecoin, Bitcoin is increasingly viewed as “digital gold,” a secure store of value that’s gaining traction among institutions. The Securities and Exchange Commission (SEC) recently approved Bitcoin exchange-traded funds (ETFs), providing financial advisors and institutional investors with a regulated avenue for Bitcoin ownership.

Major investment firms like Ark Investment Management predict Bitcoin’s value could reach $1.5 million per coin in the coming years, driven by key use cases:

Here's ads banner inside a post

- Cash Reserve Hedge: Companies and governments could hold Bitcoin alongside traditional cash reserves to hedge against inflation.

- Institutional Investment: The widespread availability of Bitcoin ETFs could make it a staple asset for investment portfolios.

- Digital Gold Standard: As a finite asset, Bitcoin could cement its status as a modern-day gold alternative.

A Speculative Frenzy or Sustainable Growth?

Dogecoin’s rally in 2024 mirrors its rise in 2021, when speculative hype drove the token to unsustainable highs. History shows that without real-world utility, Dogecoin struggles to maintain its value during market corrections.

Bitcoin, however, has a growing list of reasons to justify its increasing value. Institutional adoption, regulatory clarity, and its role as a hedge against economic uncertainty set Bitcoin apart. The current value of all mined gold stands at $18 trillion, and if Bitcoin were to match that, its price would need to rise by 850%—a scenario that’s increasingly within the realm of possibility.

That said, Bitcoin isn’t without risk. Cryptocurrencies remain speculative investments, reliant on market sentiment rather than intrinsic value. However, Bitcoin’s solidifying role in global finance offers a level of stability that Dogecoin lacks.

Will Dogecoin Be a Better Buy Than Bitcoin in 2025?

Dogecoin’s 2024 rally is impressive, but it’s unlikely to sustain its momentum without meaningful innovation or adoption. Speculators hoping for another 15,000% surge like in 2021 should tread carefully, as Dogecoin’s history suggests such gains are fleeting.

Bitcoin, on the other hand, offers a more grounded investment opportunity. With institutional interest surging and its potential to serve as digital gold becoming more tangible, Bitcoin is poised for continued growth.

While Dogecoin’s charm lies in its unpredictability and the community-driven hype it generates, Bitcoin remains the clear frontrunner as a long-term store of value. For investors seeking stability and upside potential in 2025, Bitcoin is likely to be the better bet.