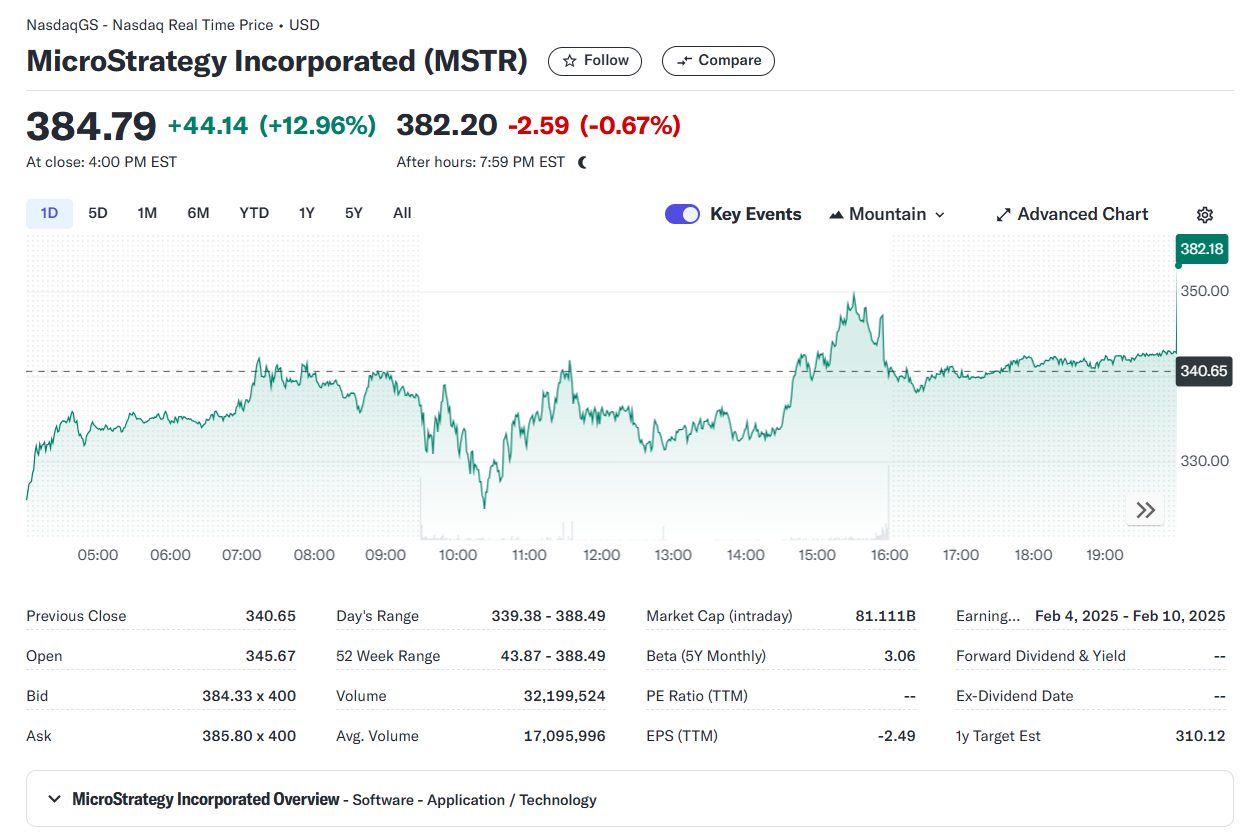

MicroStrategy’s MSTR stock surged approximately 13% to a record closing high on Monday after the company disclosed a $4.6 billion Bitcoin acquisition and announced plans to raise an additional $1.75 billion to purchase more of the cryptocurrency.

Here's ads banner inside a post

Currently, MicroStrategy’s stock has outperformed many others in the S&P 500 index. According to data from Yahoo Finance, MSTR shares have skyrocketed over 500% so far in 2024, while Microsoft (MSFT) has seen a rise of only 11%.

Michael Saylor’s Strategic Bitcoin Gamble

Michael Saylor, co-founder and Executive Chairman of MicroStrategy, has transformed his company into one of the largest institutional holders of Bitcoin globally. Saylor’s bold decision to invest heavily in Bitcoin is proving to be remarkably successful.

Not only has MicroStrategy’s stock soared, but its Bitcoin holdings have also generated substantial unrealized gains. With 331,200 BTC purchased at an average price of $88,627 per Bitcoin, the company is sitting on an unrealized profit of approximately $13.7 billion.

Here's ads banner inside a post

Plans to Acquire More Bitcoin

The company announced plans to issue senior convertible notes with a 0% interest rate, maturing in December 2029, to fund additional Bitcoin purchases. This is not the first time MicroStrategy has employed this strategy.

Previously, the company issued $875 million in senior convertible notes in September with a 2028 maturity date, as well as another issuance in June, maturing in 2032.

By leveraging convertible notes, MicroStrategy gains access to low- or zero-interest capital, which is then used to acquire Bitcoin. This strategy allows the company to capitalize on Bitcoin’s anticipated long-term price growth across market cycles.

Here's ads banner inside a post

Convertible Notes: A Smart and Low-Risk Investment

MicroStrategy’s convertible notes offer a dual benefit to investors. Investors can choose to convert their debt into MicroStrategy shares, especially appealing given the company’s strong stock performance.

If MicroStrategy’s stock continues to rise, bondholders can convert their notes into shares and benefit from the appreciation. If they choose not to convert, they can still receive their principal upon maturity, making it a relatively low-risk investment.

The Risks of Bitcoin Volatility

Despite its success, MicroStrategy’s strategy is not without risks. Bitcoin, known for its price volatility, poses a significant challenge. A sharp decline in Bitcoin’s value could severely impact the company’s financial stability and lead to substantial losses.

Holding a large quantity of Bitcoin allows MicroStrategy to benefit from its long-term growth potential, but it also exposes the company to heightened risks in the event of unfavorable market conditions.

MicroStrategy: Leading the Digital Asset Wave

Despite the risks, MicroStrategy has become a symbol of the corporate shift toward digital assets. The decision to invest in Bitcoin is not merely a financial strategy but also a way for the company to establish itself as a pioneer in blockchain and cryptocurrency adoption.

MicroStrategy’s success has inspired other companies to consider incorporating Bitcoin into their investment strategies while raising important questions about risk management in the volatile cryptocurrency market.

The Future of MicroStrategy

MicroStrategy remains firmly committed to Bitcoin’s potential. Michael Saylor believes that Bitcoin’s price will continue to grow over market cycles, and the company’s long-term holding strategy will deliver exceptional returns for shareholders.

However, given its heavy reliance on Bitcoin, MicroStrategy must strike a balance between leveraging growth opportunities and mitigating market risks. The success or failure of this strategy will not only affect MicroStrategy but also influence how other companies view Bitcoin as a strategic asset.

Conclusion

MicroStrategy’s bold Bitcoin bet has made it one of the standout success stories in the digital asset market in 2024. The sharp rise in MSTR stock is a testament to the effectiveness of its strategy.

However, with inherent risks from Bitcoin’s price volatility, MicroStrategy’s journey forward will not be without challenges. The company will need to continuously refine and optimize its strategy to protect its value and maintain investor confidence.

Can MicroStrategy sustain its growth momentum and overcome the market’s challenges? The answer lies in the resilience and ingenuity of Michael Saylor and his leadership team.