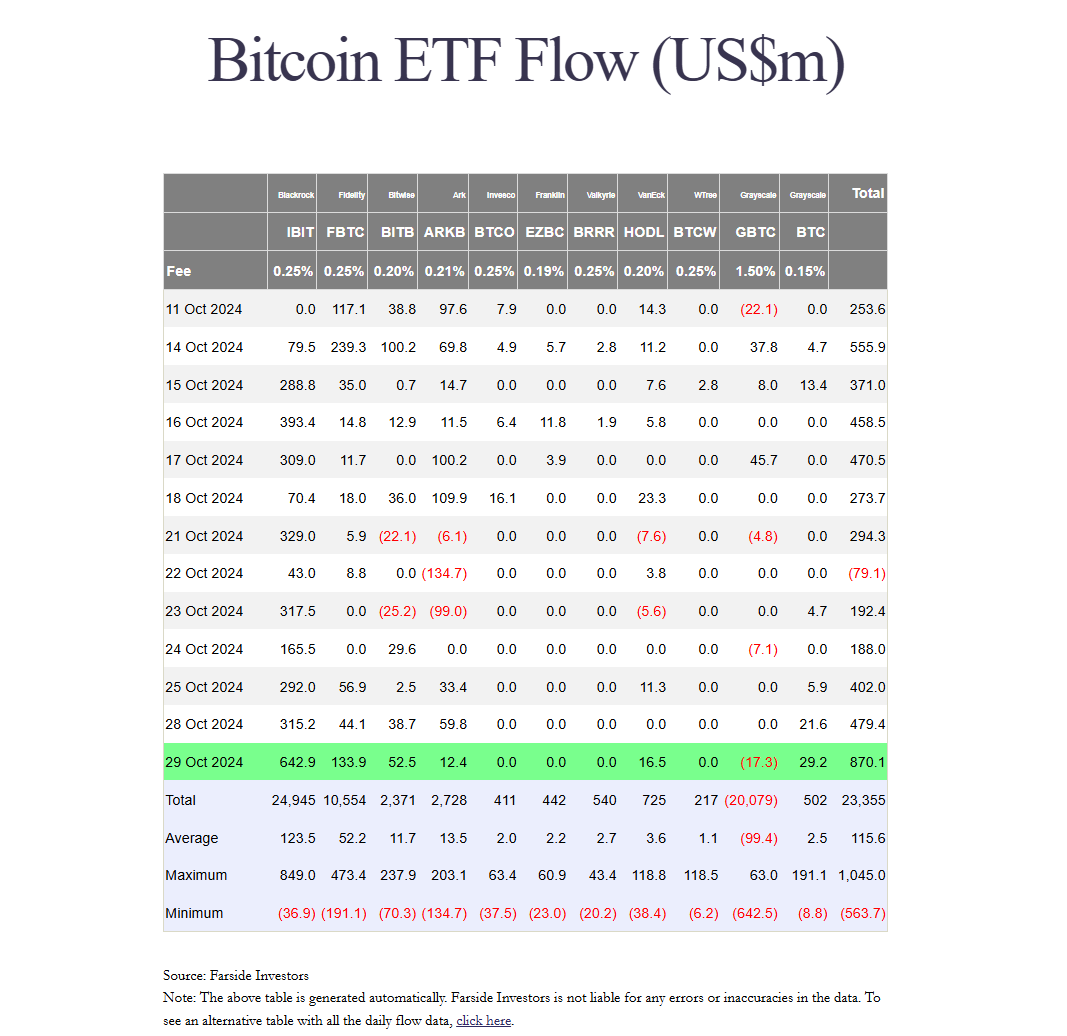

According to data from Farside Investors, US spot Bitcoin ETFs recorded a staggering net inflow of $870 million on Tuesday—marking the largest single-day influx since June 4. This surge coincided with Bitcoin breaking the $73,000 level, indicating a 7% increase over the past week, as reported by CoinGecko.

Here's ads banner inside a post

Among the Bitcoin ETFs, BlackRock’s IBIT continued to shine, drawing a record $643 million in net inflows, the highest since March 12, when Bitcoin approached its all-time high.

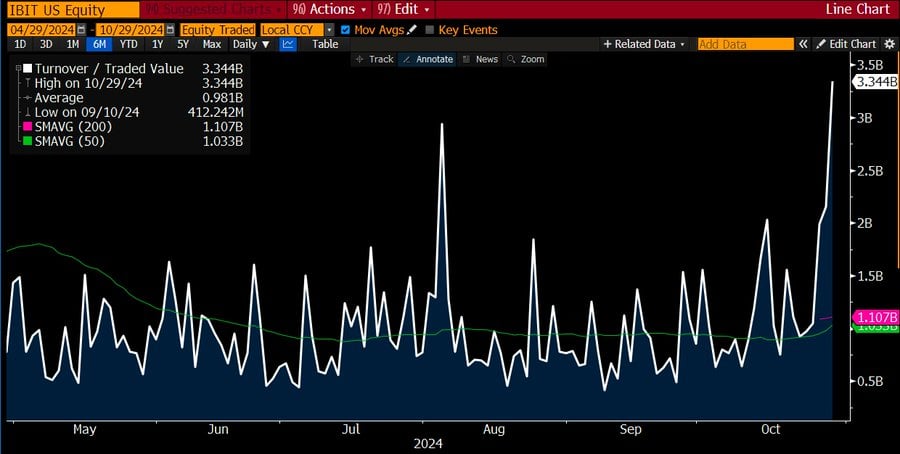

According to Bloomberg ETF analyst Eric Balchunas, IBIT’s trading volume hit $3.3 billion on Tuesday, the highest volume in six months. This spike was unexpected since Bitcoin only rose 4% on the day, which is uncommon as ETF volumes typically surge during market downturns or crises. Balchunas suggested that this high volume could be attributed to a “FOMO-ing frenzy,” similar to what happened with the ARK Innovation ETF (ARKK) in 2020.

Massive Inflows Driven by FOMO: IBIT and Other ETFs Thrive

Following the inflow reports for IBIT on Tuesday, Balchunas confirmed that investors rushed to buy IBIT due to recent price increases and fear of missing out on potential gains. Not only IBIT, but other Bitcoin ETFs also reported impressive gains on the same day.

Here's ads banner inside a post

Fidelity’s FBTC attracted approximately $134 million in net inflows, while Bitwise’s BITB, Grayscale’s BTC, VanEck’s HODL, and ARK Invest’s ARKB collectively garnered over $110 million in net capital.

In contrast, Grayscale’s GBTC experienced $17 million in redemptions. However, the fund still holds around 220,546 BTC, valued at nearly $16 billion, maintaining its position as one of the largest funds in the market.

US Bitcoin ETFs Poised to Surpass Satoshi Nakamoto’s Holdings Soon

According to Balchunas, US spot Bitcoin ETFs are on track to surpass the holdings of Satoshi Nakamoto—the anonymous creator of Bitcoin—by the end of the year. Currently accumulating approximately 17,000 BTC weekly, these ETFs are expected to exceed 1 million BTC next week, potentially overtaking Nakamoto’s estimated 1.1 million BTC by December.

Here's ads banner inside a post

Despite potential market volatility, Balchunas remains optimistic about the growth trajectory of these ETFs. Bitcoin crossed $73,500 yesterday, just $170 away from its previous all-time high, based on CoinGecko data. As of the time of writing, Bitcoin is trading at around $72,200, up approximately 1.8% in the last 24 hours.

FOMO Drives the Market: Will the Growth Be Sustainable?

The massive influx of capital into Bitcoin ETFs in a short period raises many questions about the true nature of this trend. FOMO is not just a simple psychological phenomenon; it also indicates that investors are optimistic about Bitcoin’s potential for substantial future price increases. Many are concerned that this rapid price surge could lead to a financial bubble, while others argue that it demonstrates Bitcoin’s increasing acceptance in the financial market.

This phenomenon is reminiscent of the tech stock boom in 2020, when the ARKK ETF became an investment sensation thanks to FOMO effects. However, those growth spurts can sometimes be temporary and risk decline when the FOMO sentiment subsides. Can Bitcoin ETFs maintain their appeal and sustainable growth, or will they fall into the volatility cycle similar to what tech stocks experienced?

Bitcoin Approaching a New High: Positive Signals for Long-Term Investors

For long-term investors, Bitcoin’s approach to its historical peak is a positive signal, especially as major institutions increasingly invest in Bitcoin spot ETFs. The ability of these funds to accumulate significant amounts of Bitcoin is creating substantial market power while providing a solid foundation for Bitcoin’s future.

With the current pace of capital inflow, the prospect of Bitcoin spot ETFs surpassing Satoshi Nakamoto’s holdings could soon become a reality. This development is not only a critical milestone for these ETFs but also a clear indication that Bitcoin is gradually becoming a long-term investment asset, recognized by both individual and institutional investors.

With numerous influencing factors, from institutional recognition to robust participation in Bitcoin spot ETFs, the market is witnessing a significant turning point. This not only enhances Bitcoin’s credibility but also promotes sustainable market development, paving the way for value expansion in the future.