The Semiconductor Landscape

In today’s fast-paced technological era, the semiconductor industry is at the heart of innovation, powering everything from smartphones to artificial intelligence. As one of the largest and most influential players in this field, Intel Corp. has been a cornerstone of the semiconductor market for decades. However, recent discussions surrounding the future of Intel have sparked a contentious debate. Some industry experts suggest splitting the company into two distinct entities—one focused on chip design and the other on manufacturing. Craig Barrett, the former CEO and Board Chairman of Intel, passionately argues against this idea. In this article, we will explore Barrett’s perspective, examining the implications of such a split and advocating for a unified strategy to regain Intel’s technological leadership.

Here's ads banner inside a post

The Legacy of Moore’s Law: A Driving Force

For nearly 60 years, Moore’s Law has served as a guiding principle for the semiconductor industry, positing that the number of transistors on a chip would double approximately every two years, leading to exponential increases in computing power. Intel has long epitomized this principle, leveraging its technological prowess to maintain a competitive edge. The company’s relentless focus on innovation and manufacturing excellence established it as the world’s leading semiconductor producer.

Here's ads banner inside a post

However, the last decade has seen a seismic shift in Intel’s fortunes. Once viewed as the undisputed leader, the company stumbled and lost its position amid fierce competition from rivals such as AMD, Qualcomm, and NVIDIA. As Barrett highlights, while the landscape may have changed, the fundamental truth remains: in the semiconductor industry, performance is paramount.

Here's ads banner inside a post

The Flawed Logic of Splitting Intel

Proponents of splitting Intel argue that creating separate entities for design and manufacturing would foster competition and enable the company to focus more effectively on each aspect. However, Barrett contends that this oversimplified solution ignores the complexities of the semiconductor landscape. The reality is that design companies require access to cutting-edge manufacturing technologies to optimize chip performance. Splitting Intel would create a scenario where the foundry division struggles to keep pace with competitors like TSMC, which currently dominates the foundry market due to its advanced technology.

This division would not only dilute Intel’s technological capabilities but also leave the company vulnerable to external suppliers. Barrett warns that by separating its operations, Intel would risk becoming reliant on foreign manufacturing, undermining national interests and eroding the goals outlined in the CHIPS Act, which seeks to bolster domestic semiconductor production.

Lessons from AMD: A Cautionary Tale

Barrett draws on the example of AMD, which, years ago, spun off its manufacturing operations into a separate entity called Global Foundries. Initially praised as a strategic move, this decision ultimately led to divergent paths for the two companies. While AMD thrived by leveraging TSMC’s advanced manufacturing capabilities, Global Foundries struggled to keep up with the rapid advancements in technology. The lack of sufficient research and development (R&D) funding hampered Global Foundries’ ability to innovate, resulting in a stagnant and underperforming operation.

Barrett argues that Intel risks a similar fate if it were to split. The foundry division, lacking the necessary resources and technological support, would likely fall behind, leading to diminished competitiveness and technological regression.

The Path to Renewal: Unity and Investment

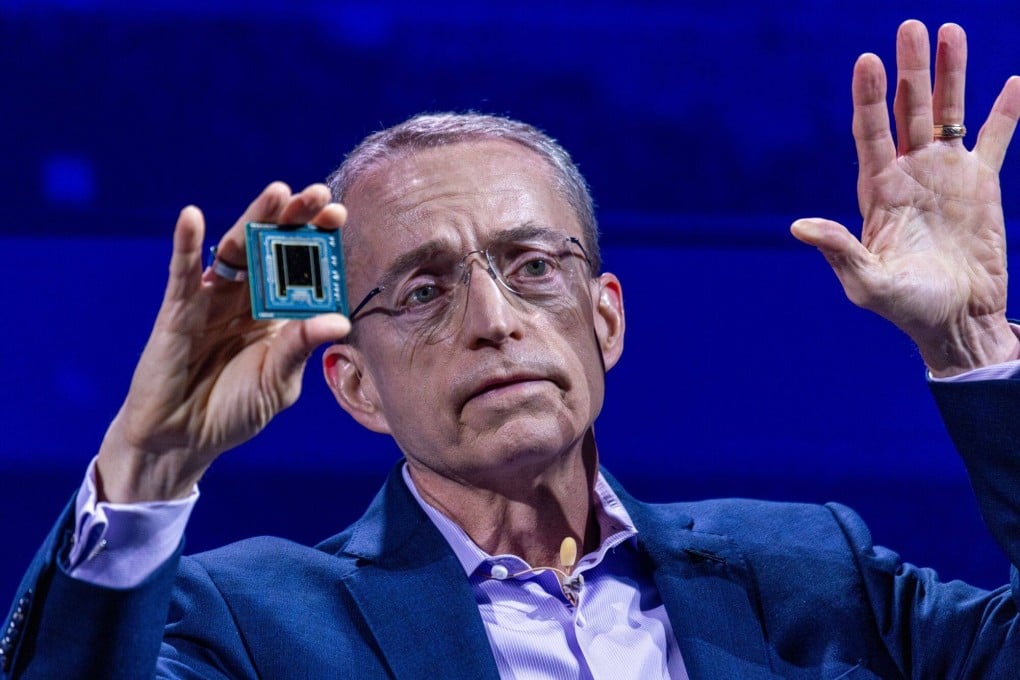

Instead of pursuing the divisive strategy of splitting the company, Barrett advocates for a unified structure that emphasizes both design and manufacturing. The current CEO, Pat Gelsinger, has embarked on a transformative journey to restore Intel’s technological leadership. By focusing on rapid advancements in node development and investing in next-generation technologies such as high NA EUV lithography and backside power delivery, Gelsinger aims to position Intel as a formidable competitor in the semiconductor space once again.

However, this ambitious vision requires significant investment, not only from Intel but also from the U.S. government. Barrett stresses the importance of increased funding for basic pre-competitive research in semiconductor technology, particularly in research universities and national laboratories. While the establishment of the National Semiconductor Technology Center marks a positive step, it is crucial for the government to provide ongoing support to ensure that the U.S. maintains its technological edge.

Navigating Complex Challenges

The challenges facing the semiconductor industry are immense. As manufacturers strive to integrate 100 billion transistors into compact silicon chips, the complexity of the task increases exponentially. To remain competitive, semiconductor leaders must invest tens of billions of dollars into research, development, and manufacturing capabilities. This investment is not merely a matter of keeping pace; it is essential for achieving breakthroughs that will shape the future of technology.

Barrett’s call to action is clear: if the U.S. intends to reclaim its leadership in the semiconductor industry, simply slicing Intel in half is not the solution. The nation must embrace the hard work of fostering innovation and driving Moore’s Law forward.

A Lesson from History: Intel’s Resilience

Reflecting on Intel’s past, Barrett recalls the dot-com bubble crash of the early 2000s when the company faced plummeting demand and industry skepticism. During this tumultuous period, some voices called for drastic measures, including layoffs and cuts to R&D spending. However, Intel’s leadership opted to maintain its investment in R&D and build new manufacturing facilities, believing that this strategy would yield long-term benefits. Despite the immediate fallout—Intel’s stock price plummeting—the decision proved prescient. When demand returned, Intel emerged stronger than before, ready to capitalize on renewed growth.

Today, Barrett believes that Gelsinger’s approach mirrors this historical resilience. By prioritizing investment in technology and manufacturing capabilities, Intel is positioning itself for future success in an increasingly competitive landscape.

A Unified Vision for the Future

The discourse surrounding Intel’s future is more than a corporate strategy; it encapsulates broader implications for the U.S. semiconductor industry and national security. Splitting Intel into separate entities could hinder progress, exacerbate dependencies on foreign technology, and ultimately undermine the nation’s technological prowess. Instead, a unified approach that emphasizes innovation, investment, and collaboration is essential for reclaiming Intel’s leadership in semiconductor manufacturing.

As Barrett succinctly states, the focus should be on driving technology forward rather than dividing the company. By fostering a culture of unity and commitment to excellence, Intel can navigate the challenges ahead and emerge as a leader in the semiconductor revolution once more. The stakes are high, but the potential rewards—both for Intel and the United States—are even greater.