Friday marked a significant milestone for Netflix (NFLX) as its stock surged 11%, pushing its value to a record high above $760. This jump occurred after the company released its Q3 earnings report, which exceeded expectations for both Earnings Per Share (EPS) and revenue. Additionally, Netflix projected its Q4 revenue to surpass Wall Street’s estimates, solidifying its dominance in the global streaming industry.

Here's ads banner inside a post

Revenue Exceeds Expectations in Q3

Netflix reported a Q3 revenue of $9.83 billion, beating Bloomberg’s estimate of $9.78 billion and marking a 15% increase compared to the same period last year. This impressive growth was driven by several revenue-boosting initiatives, including the company’s crackdown on password sharing, the introduction of its ad-supported tier, and last year’s price hikes on certain subscription plans.

Further showcasing its momentum, Netflix raised its Q4 revenue forecast to $10.13 billion, ahead of the consensus estimate of $10.01 billion. This indicates the company’s confidence in its ability to attract more subscribers and continue its rapid growth trajectory.

Promising Outlook for 2025

Looking ahead, Netflix provided a bullish revenue forecast for 2025, predicting revenue between $43 billion and $44 billion, surpassing the consensus estimate of $43.4 billion. This represents growth of 11% to 13% compared to the company’s expected revenue of $38.9 billion for 2024. Additionally, the company anticipates its operating margin to rise to 27%, an improvement over the previously reported 26%.

Here's ads banner inside a post

Netflix’s operating margin in Q3 was notably strong, reaching nearly 30%, highlighting the company’s ability to optimize costs and operations. Maintaining such a high margin in an increasingly competitive entertainment industry underscores Netflix’s financial strength and strategic acumen.

Earnings Per Share (EPS) Exceeds Estimates

Another highlight of Netflix’s Q3 report was its Earnings Per Share (EPS), which came in at $5.40, significantly above the consensus estimate of $5.16 and far ahead of the $3.73 reported in the same period last year. This achievement demonstrates that Netflix has not only sustained its growth but also improved its financial efficiency.

For Q4, Netflix projects an EPS of $4.23, ahead of market expectations of $3.90. This further reinforces investor confidence in the company’s profitability, even amid a challenging global entertainment market.

Here's ads banner inside a post

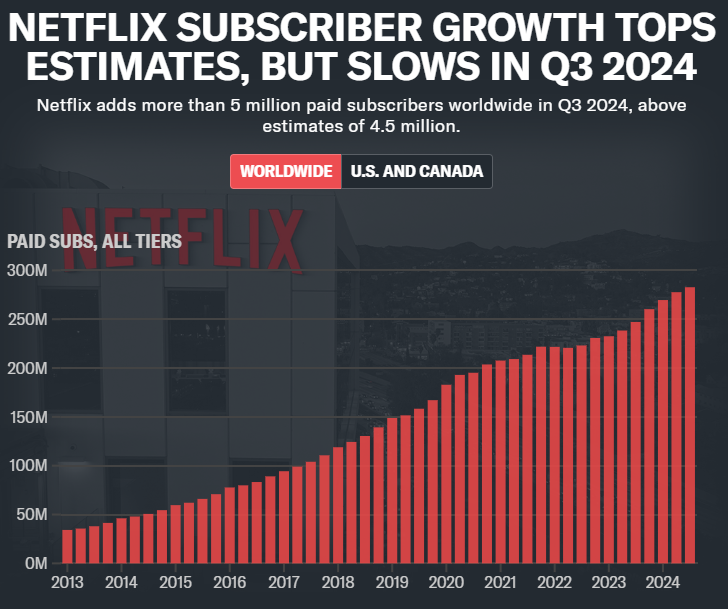

Subscriber Growth Continues to Impress

Netflix’s subscriber growth was another standout in the Q3 report, with over 5 million new users joining, thanks to hit shows like “The Perfect Couple” and “Nobody Wants This.” With 5.07 million new subscribers, Netflix surpassed expectations of 4.5 million, building on the 8.05 million added in Q2. In total, Netflix gained 8.8 million paying users in Q3 2023.

The company is optimistic that subscriber numbers will continue to rise in Q4, driven by seasonal trends and a strong content lineup, including Squid Game Season 2, the Jake Paul vs. Mike Tyson fight, and two NFL games on Christmas Day.

Expanding into Sports and Live Events

A noteworthy development is Netflix’s expansion into the sports and live events sectors, a bold move that has garnered praise from investors. This strategic shift has not only broadened Netflix’s content offering but also allowed the company to tap into new revenue streams by attracting sports fans and event enthusiasts.

Additionally, Netflix’s ad-supported tier has gained significant traction, accounting for over 50% of new sign-ups in countries where it was offered during Q3. This shift in consumer behavior demonstrates a willingness to adopt new streaming models as long as the content and user experience remain high quality.

Building a Promising Advertising Business

In its financial report, Netflix also emphasized the importance of building its advertising business as part of its long-term growth strategy. The number of ad-tier subscribers increased by 35% quarter-over-quarter, and the company plans to launch its ad-tech platform in Canada in Q4, with further expansion planned for 2025.

This growth highlights the potential for Netflix to create new revenue streams through advertising while enhancing its offerings for both users and advertisers. It’s a long-term strategy aimed at diversifying revenue sources and reducing the company’s reliance on subscription price increases and subscriber growth.

Conclusion

Netflix’s success in Q3 2023 is not only the result of smart financial strategies but also the company’s investment in high-quality content, its ability to adapt to market demands, and its willingness to implement bold business initiatives. With strong future growth plans, including further expansion into sports and live events, and a robust advertising tier, Netflix has proven that it is not only maintaining its leadership position but also evolving to meet the challenges of an ever-changing, competitive entertainment industry.